Acknowledgements

The ideas in this paper are a collaborative result of many talks and discussions, online and in person, with some brilliant minds of the crypto-economic space. The Etherisc team would like to say “thank you” especially to the following people, who added considerable value to the draft: Ron Bernstein, Jake Brukhman, Alexander Bulkin, Alex Felix, William Mougayar, Micah Zoltu, to the current team, consisting of Matthias Zimmermann, Jan Stockhausen, Michiel Berende, Hui Lin Chiew, Sebastian Schlitter, Peter Koch, Koenraad de Jonghe, Damian Groß, Felizitas Mussenbrock-Strauß, Lydia Mussenbrock and last but not least all those members of our telegram channel and discord server, who gave valuable feedback and criticism and encouraged us to follow our path.

1 About this Document

History

As a result of the Nov/Dec 2016 Hackathon, the Etherisc team wrote a whitepaper, which was released to the public in its Version 0.3. Focus of the hackathon was the attempt to outline the core of a blockchain based reinsurance market.

Two years later, we released version 1.01 of the whitepaper for the DIP token sale which took place from June 23rd to July 25th, 2018. The 2018 whitepaper outlined the main features of the Etherisc ecosystem, and also important aspects of the DIP token. It was already clear that staking would emerge as the core token utility, however, a long way had to be gone to iron out the details.

We also had only a rough idea of what the insurance framework would look like. Immediately after the token sale, we started implementing the framework which was released as “GIF Framework” in 2019.

The Elevator pitch

Giant corporations dominate the multi-trillion-dollar insurance industry. The insurance industry developed into an indispensable part of the modern economy, whilst sometimes being inefficient, intransparent, expensive and with inferior customer experience. It has become a commonplace to say that insurance is boring and unreliable.

When customers need help the most, they can struggle in vain to get reimbursed by corporations whose profits too often depend on not paying.

| Etherisc has built a platform for decentralized insurance applications that can be used by anyone who wants to offer insurance. Large and small companies, non-profit groups, or insurtech startups. |

|---|

To foster open innovation in the insurance space Etherisc has open sourced its platform from the beginning. It is Etheriscs goal to support a growing ecosystem that is owned and managed by the community of all participants.

We want to create insurance products that are transparent, fair and accessible for both customers and investors.

Etherisc can thus become the most widely used insurance platform in the world, providing insurance coverage to millions of underserved customers.

The Etherisc platform is built around a technical, blockchain-based Framework called “GIF.” GIF is an acronym that stands for “Generic Insurance Framework.” It consists of open-source smart contracts that implement generic insurance product and policy lifecycle functions. Thus, GIF enables a wide range of insurance types. GIF runs on a blockchain and is multi-chain and multi-tenant capable.

The GIF is particularly suited to host parametric insurance products. Parametric insurance covers predefined loss events immediately when they occur, with predefined and deterministic payouts, rather than compensating for actual damage. Events such as flight delays, droughts, heavy rainfall, or damage caused by hurricanes are covered.

| In parametric insurance loss events (the risks) are defined as functions of underlying indices or parameters that meet the criteria defined by the insurance product. |

|---|

The GIF is open source, so anybody can deploy their own GIF instance, modify the code, fork it etc. However, we believe that a flourishing platform needs more than just some lines of code.

Therefore, any GIF instance can optionally be registered in a global registry which is maintained by a DAO, in which all platform stakeholders participate in the governance. Registered GIF instances need to comply with a set of rules which ensure that customers can feel safe when they interact with a registered GIF instance. This is achieved by granting badges and certificates to compliant GIF instances.

In this system, the native DIP token (Decentralized Insurance Protocol) plays a central role. Every participant and stakeholder is required to stake a certain amount of DIP tokens. Therefore, the DIP token is a utility token, with staking being the central utility. Staking is needed both for deploying products, oracles and risk pools, but also for investing in those risk pools. Staking will also grant voting rights in the governance model.

Chapters

This whitepaper is the attempt to structure the overall picture of decentralized insurance along the new insights. The document is structured in 4 main chapters:

In chapter two, we explain the fundamental facts about insurance and the disadvantages of traditional insurance. We highlight the advantages of blockchain and the decentralized model in insurance and explain the interplay between customers, users and companies.

Chapter three explains the Etherisc perspective on insurance, policies, and parametric insurance. We define the three pillars of the Etherisc ecosystem and get into the technical side of GIF (Generic Insurance Framework). We define the generic lifecycle of the GIF functions. At the end of the chapter, we introduce the GIF Monitor.

Chapter four explains the DIP token and how it is used in Etherisc staking. We describe our staking model, the interaction of the different corresponding risk pools and the functions of the different tokens. The chapter is concluded with the topic of credits rewards and payment losses.

Chapter five deals with EGM (Etherisc Governance Model). We define the five core values as respect, partnership, responsibility, trust and public goods. They were followed by the structure of EGM and the participants and their roles. Details about the topics of global staking pool and monetary policy then round off the whitepaper with the appendix.

The final chapter six contains a list of all abbreviations and definitions of the most important terms.

2 Analysis of basic insurance paradigms

2.1 Overview

To understand the approach, strategies and goals of (this) insurance, it’s important to look at a general definition of what insurance is and does:

| “Insurance is a means of protection from financial loss in which, in exchange for a fee called “premium”, a party agrees to guarantee another party compensation in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss.”[1] |

|---|

This can occur as a contract in the form of a financial protection policy. The insured is the policyholder, whereas the insurer is the insurance-providing company, the insurance carrier, or the underwriter.[2]

Having analyzed the basic principles of insurance, such as the definition, and having developed a token system on top of these principles, we can now analyze insurance and break costs and capital flows down into three elements:

Expected value of risk

Which is simply the redistribution of capital according to the risks among the participants.

Capital costs for tail risks

As the name indicates, the capital in risk pools is exposed to a risk of loss and must be held in the risk pool for a certain period. The capital providers are compensated for this risk. This compensation is calculated based on the limitation period and the insured risk.

Transaction costs

Costs of administration of insurance policies, for example, gas fees of bookings on the blockchain, booking fees in case of payment in FIAT money, costs for oracles, etc.

We argue that traditional insurance companies dominate these building blocks and thus rule the insurance market. The GIF framework and the underlying blockchain technology offer the opportunity to replace the encrusted processes of traditional insurance companies with lean decentralized structures using standardized and automated lean protocols. Tokens thereby map the capital and revenue flows.

Our conclusion from this analysis is that we need two types of tokens. The first one - the “DIP Token” - supports the coordination and economical incentivization of actors in a decentralized insurance system.

The second type of token represents risks - this type is not a single token but a class of similar tokens, one for each risk pool, we call those “risk pool tokens”.

In a distributed environment with many participants, building products as a collaborative effort, the protocol token serves as glue, as collateral, and as representation of the material and immaterial value of the network, much as Ether serves as a means to secure the stability of the Ethereum Blockchain.

In Chapter 4.1, we detail the DIP protocol token. Chapter 6 shows a concrete example of the use of the token in an insurance context.

2.2 Principles of insurance

We explain the principle of insurance with an example. The example is of course simplified, and serves the sole purpose to explain the principle.

We consider homeowners insurance. For customers, insurance is about probabilities of losses, so it would be interesting to see what the probability of a damage is. A homeowners insurance typically covers a number of perils, including fire, natural disasters, water, and even falling objects.[3]

But it is difficult to obtain real numbers, as insurance companies are not very transparent with their fundamental data.footnote:[A quick market survey in Germany shows that you get a homeowners insurance for considerably less than 0.1% of the value. For simplicity, we’ll assume that the premium is 0.1% plain and we don’t take insurance taxes etc. into account.

From the relation premium/value, we can easily estimate an upper bound for the probability. One of the most fundamental principles of insurance is that the expected losses should not surpass the collected premiums (“Risk loading” - cf. http://www.wiley.com/legacy/wileychi/eoas/pdfs/TAP027-.pdf). The expected losses are - simplified - number of policies multiplied with the probability of loss multiplied with the loss (which is equal to the value), and collected premiums are number of policies multiplied with premium per policy. It follows that the probability can be approximated by premium/value, which is lower than 0.1% in our market test.]

We will assume that, for our example, the probability is 0.1%.

For our fictional example, let’s assume insurance had not been invented yet. In this fictional world, Alice owns a house. The house is worth $100K. The probability of a complete disaster is 0.1% per year (that is one devastating event in 1,000 years). Alice wants to ensure that she has access to enough funds to get a new house in the case of a disaster. So she decides to get a loan of $100K and has to pay redemption (also called principal) and interest rate.

Additionally, she pays an interest rate of maybe 1%, so she has yearly costs of $1,100 ($100,000 loan * 1% interest rate plus $100 annual redemption = $1100.00).

Now we show how pooling risks in an insurance scheme reduces these costs drastically.

2.2.1 Sharing the expected value of risk

Assume 100,000 homeowners are coming together in a pool. Again, everybody pays a $100 share; this amount is now called the “premium”. They collect a total of $10,000,000 in premiums. But now there is a difference to Alice, who takes care only for herself: because of the law of large numbers[4], with a very high probability there will only be about 100 fires, causing a damage of about $10,000,000! And because the sum of all premiums is also $10,000,000, the whole damage can be paid out of the collected premiums, there is no need for every house owner to take on a loan. (Because premiums are collected at the beginning of the year, and all the houses “expected” to burn don’t all burn at the beginning of the year, but more or less are equally distributed over the year(s), there is a so called “float[5]” of liquidity which can also generate a significant revenue. For simplicity, we won’t focus on this effect in this paper.

So the costs for each single house owner are now reduced from $1,100 to $100!

This difference asks for an economical explanation. Let’s have a closer look. First, if all house owners would follow Alice’s example, they would need a huge loan, from which only a tiny part of 0.1% would be needed on average. It is clear that providing unused liquidity is costly.

| Pooling of risks in insurance optimizes the use of capital, and the participants benefit from the reduced costs, not to speak of the difficulties to obtain a loan without collateralization! |

|---|

Second, if everybody only cares for himself, only a tiny fraction of participants are struck by disaster, and have the burden of actually paying back their loan. The others can pay back without loss, as long as they don’t need protection. In an insurance collective, we have solidarity: with the premiums, everybody pays for the damages of the others.

To summarize, the risk pool offers three advantages for the participants:

-

Building a large liquidity pool.

-

Guaranteed access to this liquidity in case of a damage.

-

Mutual subsidizing of damages.

Such a pool may be designed solely to benefit its’ participants, and to not make any “profit”. If the pool did generate profits, these profits could be distributed back to the participants, effectively reducing the premiums again to a level where no profits are generated. Such an insurance would have a loss ratio of 100%, because all premiums are used to pay the losses.

This is the very basic effect of risk transfer in insurance. Please note that the effect increases with the pool size.

But still, this is not the whole story.

2.2.2 Sharing the tail risks

In some years, there are more fires, in other years, less. To account for these variations in damages, the whole pool has to raise some money, e.g. $10M, to cover the unlikely event of a burst of many fires in one particular year. And let’s suppose that the interest rate for this capital is even particularly high, e.g 20%. We will have total costs for this capital of $2M. The interest rate for the capital is a function of the risk and the riskless interest rate on the capital market; in an efficient market, the interest rate will compensate for the higher risk in comparison with a risk-free investment and will also contain a fair profit. So basically, this is where profits are generated for providing capital in an insurance structure.

The overall costs of $2M are distributed among all house owners, yielding an additional cost of $20 per house owner per year, which is added to the premium.

So after this, there is also a protection against “tail risks” or “black swan events”, at a cost of $20 per house owner. Again, the risk diversification effect increases with the pool size.

Overall, participants now pay $120 per year for their house insurance. The loss ratio is now reduced to 83% because of the capital costs of protecting the tail risks.[6]

2.2.3 Sharing the transaction costs

To organize 100,000 people in a pool, a professional structure is needed. Otherwise, every single participant would have to coordinate, which would simply be impossible. The operation of this professional structure adds transaction costs to the premium. This is the reason why insurance companies have come into existence:

| _They provide a way to decrease transaction costs for the participants of the pool, creating an economy of scale and coordinating a huge number of participants and employees.[7] _ |

|---|

The effect is considerable and enables the modern form of insurance with huge customer bases and a capitalization which can cover even global catastrophic events like hurricanes and earthquakes. However, the remaining transaction costs are still considerable: a recent study by KPMG shows the impact on the loss ratio, which is about 66% in the average.[8]

2.2.4 Information asymmetry

Together with the reduction of transaction costs comes an asymmetry of information, which leads to a further increase of costs and to incredible profits for the big insurance companies.

| The unbounded collection of customer data and the exclusive exploitation of this data is a consequence of this imbalanced relationship. |

|---|

It creates an “unfair competitive advantage” for existing companies: companies with big data vaults can offer better products, and thus further optimize their database.

One of the core goals of a decentralized insurance platform is the disruption of this circle, giving back to customers the ownership of their data.

2.2.5 Summary

The three elements described above; risk pooling, risk transfer, and efficient administration are necessary. You can’t have insurance without each of them.

For the purposes of this paper, I will call them:

-

expected value of the risk

-

capital costs for tail risks

-

transaction costs

As we have seen, a community may not wish to generate profit from the first element. The second element yields a risk fee for binding capital which depends on the structure of the particular risk: It is typically lower if the risks are granular and uncorrelated; it is typically higher if the risks are clustered or correlated. The third one depends on the complexity of the process. A simple and highly standardized insurance “product” has a smaller transaction complexity than a more complicated, non-standardized product. This will be reflected in lower transaction costs.

The three elements are completely independent of the underlying technology, economic environment or currencies. They are the atomic building blocks of every risk-sharing system.[9]

As an additional aspect we have seen the information asymmetry which is inherent in the traditional insurance systems, and which is undesirable.

The distribution of expected value (element 1) and capital costs for tail risks among participants (element 2) is inevitable and not specific for a blockchain solution. Therefore, let’s focus on the third element.

| Utilizing blockchain technology, an arbitrary number of participants can coordinate on an economic task without the legal structure of a firm, with significant gains in efficiency and respective reduction in transaction costs. |

|---|

Transaction costs also appear in another context: regulations, which are deemed necessary to protect customers in a context with built-in conflicts of interest. Regulations form a very effective “competitor” barrier to entry. While insurance companies often complain about the burdens of regulations, they actually don’t have much interest in reducing these burdens, as they discourage new competitors from entering the market.

2.3 Blockchain helps to solve issues of traditional insurance

While the current insurance business has evolved over centuries, and is optimized in many aspects, we have seen that it has severe shortcomings to the disadvantage of customers. We will outline some properties of an alternative system, which remedies these shortcomings.

First, an alternative system should of course offer the basic ingredients of any insurance system: covering expected losses, covering tail risks, and covering necessary transaction costs. Obviously, we need ways to capitalize such a system, and we need a system to reduce transaction costs to a minimum. Transaction costs cannot be eliminated completely. But open markets have proven to be a solution for these challenges, and therefore, we propose a market-based approach with two components:

-

an open marketplace for capitalization of risks

-

an open marketplace for insurance related services

This is where blockchain comes into play:

| A_ decentralized solution on the blockchain implements such open marketplaces in a way that is collusion resistant and has no single points of failure._ |

|---|

We can watch the emergence of many such marketplaces for different domains, like computation, file storage, exchange of assets; and insurance is just another domain in this respect.

More specific, blockchain helps to solve some of the main problems which pile up costs in traditional insurance companies:

-

Coordination (“managerial”) costs.

-

Conflict of interest between customers and company.

-

Information asymmetry between customers and company.

-

Restricted access to risk pool profits

-

Long time to market

-

Limited access to certain capital markets (e.g. crypto)

Advantage 1:

Cheaper as coordination costs are low. In traditional firms, you have two types of employees: the first group is doing the actual work, the second group is coordinating the whole system. The larger a company grows, the more energy flows in the second group (like a circle, the first group forms the rim of the circle, the second the area; the larger the circle, the less efficient are the processes, and the more energy flows into the coordination of the coordinators). Blockchain helps reduce these coordination costs. Instead of a posse of managers, “smart contracts”[10] act as trustless hubs between the agents at the rim of the system, and thus eliminate most of the costs and inefficiency of management.

Advantage 2:

More transparent / independent / trustworthy . In a traditional insurance company, the company “owns” the whole process, including the tasks which tend to raise conflicts of interest between customer and company. A perfect example is claims management: The claims manager has the explicit goal of minimizing payouts for damages, because they are an employee of the insurance provider! Of course there is a guild of “independent” appraisers and experts, but who pays them?

Blockchain solves this conflict of interest, by enabling truly independent experts (who for example may be publicly ranked by their reputation for efficiency or fairness), and whose work is independent of the insurance provider, as well as transparent and auditable by the whole community.

The same is valid for another area, where the conflict of interest is (intentionally) not obvious; consider Product Design. An insurance company has a big advantage over customers, because they can design products in a way which perhaps unfairly maximizes revenues (sales) and minimizes payouts (expenses).

For example if a customer expects a payout from an insurance policy they bought for a particular “event” but the insurance company does not provide the payout because the company maintains that the policy bought doesn’t actually cover that “event”, the customer experience is severely degraded and trust is eroded between consumers and insurance providers.

Advantage 3:

More transparent / fair through blockchain smart contracts. Insurance companies collect data and information in huge private silos in proprietary ways, and the data is often not shared. This information asymmetry is a source of inefficiency and the origin of high transaction costs.

The experience of companies in analyzing this data is considered one of the key differentiators in the market. Decisions based on this data are not transparent and difficult to challenge due to the lack of insight into the evaluations.

In a blockchain environment, however, all fundamental data and the decisions based on this data are transparent and objectively validated.

Advantage 4:

Democratised access. The risk pools of traditional insurance companies are attractive investment instruments. However, they are not publicly accessible and the profits generated benefit only a small group of investors.

Blockchain democratizes access to risk pools by tokenizing risks with "risk pool tokens." |

Advantage 5:

*Flexibility and scalability *Composability is the general ability of components of a system to be recombined into larger structures and for the output of one to be the input of another. In simple terms, the best example is Lego, where every piece can connect to every other piece. Within Crypto, composability is the ability of decentralized applications (dApps) and DAOs to effectively clone and integrate one another (syntactic composability), and for software components such as tokens and messages to be interoperable between them (morphological composability).

Advantage 6:

*Blockchain enables more efficient collateral management. The creation and digitization of collateral tokens like stablecoins or similar assets and new financial primitives like staking facilitate new markets and possibilities.

2.4 Why insurance can benefit from decentralization

2.4.1 Why is insurance a candidate for decentralization?

As a multi-trillion dollar industry dominated by huge corporations, insurance is often confronted with obstacles such as strict regulations, and misalignments of company and consumer incentives, which led to the insurance world often being inefficient and expensive. The ultimate goal is to avoid cases like customers having to fight for reimbursement from companies whose profits often depend on avoiding paying out in a targeted manner.

Etherisc is building a platform for decentralized insurance applications. The platform can be used by corporates, large and small, not-for-profit groups and insurtech startups to provide better products and services. We aim to use blockchain technology to make insurance faster, cheaper and more transparent and democratize access to investing in insurance products.

| Blockchain can provide the means to disintermediate the market with a peer-to-peer risk platform that helps insurance return to its roots as society’s safety net. |

|---|

We encourage new groups building their own bespoke insurance risk pools and services on the platform. Etherisc framework enables fully-compliant and licensed insurance products for the emerging blockchain economy. To offer an alternative to traditional monolithic insurance systems, we can identify some requirements and consequences for implementing a decentralized insurance protocol.

2.4.2 Properties of decentralized insurance

-

The range of insurance is huge and far too complex to be covered by a single application. Therefore, we need a protocol and not just a (decentralized) application. Some tools are needed to incentivize participants to use it. Promoting "network effects"[11] is one tool that can lead to a sustainable and growing user base.

A policy may cover a particular product, but a single policy will not generate the network effects to create multiple large pools of similar risks necessary to take advantage of the "law of large numbers." -

A decentralized insurance protocol can partially or fully replace the traditional insurance business model. It does this through disaggregation of end-to-end processes, autonomous and automated smart contracts and procedures, a set of interaction rules for stakeholders and smart contracts . At the same time, a protocol allows for flexible extension and interpretation of the basic rules.

-

The development and operation of a protocol needs funding. Even if we can drastically reduce the coordination costs, there are still the costs for the initiation of the system - e.g. acquisition of licenses, development of smart contracts, audits, as well as costs for agents at the “rim” of the system which we cannot eliminate completely. Therefore we need a way to collect these costs from the ultimate customers and distribute them amongst these agents.

-

We also need a way to calculate and distribute the expected value of the risk and the capital costs for covering tail risks amongst the customers.

2.5 Protocol

2.5.1 Owner of the protocol, governance

As an open standard, the protocol is a common good, it can be used and implemented by whoever likes it. We will take care that the entry barriers are as low as possible. However, for some portions of the protocol, a certification will be necessary, to reflect regulatory obligations and restrictions. We have founded a swiss based foundation as a legal body, which formally holds the IP rights of the protocol and ensures that the protocol can be used freely. We established a continuous, community-driven protocol improvement process similar to the EIP process for the Ethereum Platform.

The Etherisc Governance Model (EGM), its abstract and core values as well as other subtopics will be further elaborated in Chapter No.5.

2.5.2 Outline of workflow elements of the protocol

-

Application for policy

Process of offering a product and applying -

Underwriting

Process of accepting a policy -

Collection of premiums

Payment process, one-time and regular payments -

Submitting of claims

Process of submitting a claim, via oracle or manually -

Claims assessment

Process of assessing a claim, via oracle or manually. A claims verification process allows the system to determine which policies are legitimately claimed and to propagate agreed payments to claimants. In the case of parametric insurance, this process references data feeds about insurable events and is (fully) automated. -

Identity Management & Privacy

Process of KYC and AML, respecting privacy. This may involve private chains or off-chain storage of data. -

Admission / Certification

Admission of participants to offer products and perform parts of the protocol -

Asset Management

As funds flow in, we have to responsibly use funds which are not immediately needed.

2.6 Community of customers, users and companies

The success of the platform will depend on a vivid community of users and companies. The token model reflects and supports this community. This community plays a central role in the realignment of incentives. Via tokens, customers can “own” their insurance. The community model facilitates the development of future mutuals and P2P-Insurance models.

| A community cannot be built from the outside, it has to grow from the inside. |

|---|

However, experience shows that there are some success criteria for communities. Famous open source pioneer Pieter Hintjens, http://hintjens.com/blog:10 has drafted some which we consider to be helpful for an in-depth discussion:

-

Quality of mission

A community can only grow by pursuing a worthwhile goal. The goal must be super-individual. -

Freedom of access

The community should not have barriers or walls, it should welcome those of goodwill and encourage participation. -

Well-written rules

If rules are necessary, they should be carefully written and obvious. -

Strong neutral authority

To resolve conflicts, a strong but neutral authority should be in place, which can be incorporated by a governance mechanism. -

Proportional ownership

"You own what you make" -

Infinite spaces

A single large project with many owners does not scale as well as a collection of many small projects, each with one or two owners. Communities grow best when people layer project upon project without limit. -

Measurements of success

In the community, your voice is as loud as the number of people using the project you “own.” -

Tools and processes

Much better tools means a faster, more efficient community. -

Freedom to organize

Let the community participants identify the problems, allocate the resources, and monitor success, precisely without top-down management. -

Transparency

Secrecy enables incompetence, and transparency promotes competence. The more public the organization’s work, the better. -

Unstructures

“Everyone owns what they make” and be prepared to move to a new home as and when needed. -

Scalable participation

You want no barriers at any point, but it must get harder and harder. This makes the community feel like a massive multiplayer game, where there’s always someone better than you, and you just have to try to catch up.

3 GIF - the Generic Insurance Framework

The GIF consists of building blocks that include the complete value chain: the insured, the insurer, the investor and the instance operator. First of all, you need insurance products that you can sell. The insurance products have a product owner who designs the products. The insurance products themselves are from smart contracts.

| Oracles are an essential part of the GIF for implementing parametric insurance. Oracles provide the necessary data, for example, flight or weather data, to the contracts in a GIF instance. |

|---|

The risk pool is also a smart contract that keeps track of all details of the risk capital, the amounts paid in as policies and all the amounts paid out.

A GIF instance connects these individual roles and represents a complete executable entity defined by the GIF. Each instance consists of a blockchain’s operational set of GIF smart contracts. Different blockchains may run different instances.

3.1 Etherisc-basics about insurance

In the chapter '2.2 Principles of insurance', we used a practical example to illustrate how insurance is created and functions with the insured’s participation. In these chapters, we will explain and define insurance from the perspective of Etherisc.

3.1.1 What is insurance?

| Insurance is a means of protection against financial loss. It is a form of risk management whose primary purpose is to protect against the risk of possible or uncertain loss. |

|---|

Insurance is a means of protection against financial loss. It is a form of risk management whose primary purpose is to protect against the risk of possible or uncertain loss. The loss associated with the risk may or may not be financial, but it must be reducible to financial terms.

An insurance company[12] underwrites the risks of the insured. The insurance company can outsource all services, such as sales or data management, to other service providers. The only exception is the actual assumption of risk. This risk must always remain with the insurance company. Therefore, the company and their customers always need to have a proper accounting on which risks they cover and how it is collateralized.

| Via smart contracts, this can be done in a transparent and auditable way. |

|---|

3.1.2 What is an insurance policy?

An insurance policy is a contract provided to the insured by the insurance company that sets out the conditions and circumstances under which the insurance company will make payouts to cover losses incurred by the insured due to recognized claims. In TradFi, this is typically a legal contract. In our context, a policy is simply a dataset stored on blockchain and manipulated via defined rules by a smart contract.

Let’s look at the lifecycle of a typical insurance policy. Such a lifecycle usually consists of the following chronologically listed sub-steps.

-

The customer inquires about an insurance policy. They want to protect themselves against a specific risk by taking out an insurance policy.

-

The insurance company examines the customer’s application.

-

The application is accepted or rejected.

-

In case of rejection, the customer is informed and no further activities occur.

-

In case of acceptance, the contract comes to the “underwriter.” The acceptance of the application is called “underwriting.”

-

The insurance company commits itself by the “underwriting” to take over the customer’s risk and transfer it to itself. It further undertakes to cover the loss if the insured event occurs.

-

The customer, for his part, undertakes to pay the premium.

-

Both declarations of obligation are documented in a contract. This contract is called the insurance policy.

-

If a claim occurs, the customer reports it to the insurance company.

-

The claim is checked by the insurance company and accepted or rejected.

-

In case of acceptance, the agreed insurance sum is paid out. It is easy to see that the classic insurance business generates considerable bureaucracy and that many individual sub-steps require manual activities. For example, when a customer files a claim, the insurance company has to check the claim’s details manually. This involves work and, therefore, costs.

3.1.3 What is parametric insurance?

Parametric insurance is an agreement between the insurance company and the insured that covers the occurrence of predefined events rather than manually reviewing and compensating for actual losses incurred.

Parametric insurance policies correspond to agreements between the insurance and the insured where the insurance approves payouts to the insured when predefined triggering events occur.

In parametric insurance, loss events (the risks) are defined as functions of underlying indices or parameters that meet the criteria defined by the insurance product. Example indices/parameters include rainfall amounts and wind speeds for insurance linked to weather conditions. In the case of flight delay insurance, the parameter/index can directly be derived from the difference between the actual arrival time and the scheduled arrival time of an insured flight.

| To make parametric insurance feasible and attractive to all involved parties, the underlying indices/parameters must be transparent, reliable and trusted. |

|---|

Once such events occur, the insurance directly calculates and triggers a payout to the insured without an often costly claims acceptance process.

The big win of parametric insurance is its potential for efficiency and automation. Claims handling, one of the most complex and costly parts of the insurance business, can be reduced to a simple and fully automated process.

3.1.4 What are the advantages of blockchain in insurance?

There are several benefits that blockchain technology can provide to the insurance domain. Some of these benefits are directly related to the foundations of blockchain technology.

-

Transparency and accountability for record keeping. Information regarding policies, claims and payouts may be stored on-chain. Once on the chain, they can neither be deleted nor changed without proper permission, and each time data is updated or adjusted, the original data is kept in the history. An entire audit trail is available and transparent for all data.

-

Minimize friction and transaction costs for payment handling.

-

Create new markets/opportunities by opening risk pools. The transparent pooling of large numbers of insurance policies of a particular type provides the opportunity to open up this market to a wider audience.

-

These new markets also include the option to trade risks in small quantities, so called “Risk Pool Tokens.”

Blockchain technology can provide a lot of value, especially for parametric insurance.

-

Providing this central data in a trusted way to the blockchain world will be managed through oracle services, making it very hard/too costly to inject manipulated index/parameter information into smart contracts implementing parametric insurance policies.

-

Once the index/parameter feed is provided to policy contracts, parametric insurance will fully automate claims and payout handling.

-

Immediate payouts. Running in a blockchain context and having automated claims/payout handling allows for near-real-time payouts.

3.2 The Etherisc model

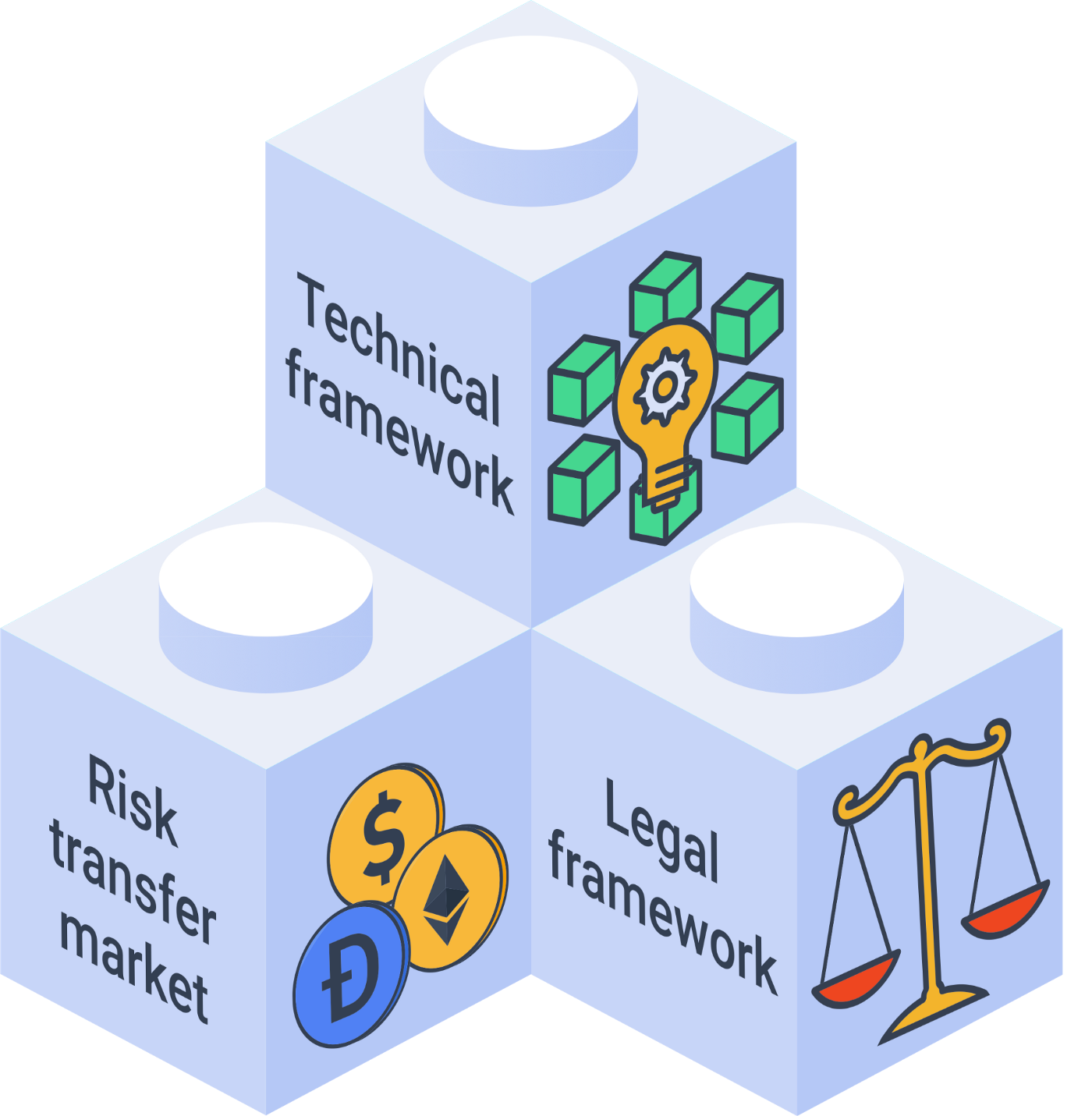

3.2.1 The three pillars of the Etherisc ecosystem

Risk transfer market

Raising capital to back the technical guarantees is done by investors. Investors will lock a certain amount of DIP tokens, also known as “staking.” The staked DIP tokens are a prerequisite to be then able to invest the actual risk capital in DIP or stablecoins.

The community of DIP token holders created the entire Etherisc ecosystem. Therefore, we will demand that parties who profit from the ecosystem own a share by holding and staking DIP tokens. This idea is borrowed from the space of cooperative enterprises. It reflects that the Etherisc ecosystem is a public good that needs to be protected from the “tragedy of the commons.”

Legal framework

Insurance companies are highly regulated worldwide for good reasons, to protect customers and investors. A great deal of legislation has been enacted for this purpose in most countries. Concerning jurisdiction, a general distinction can be made between the American, European and Anglo-Saxon regions.

But even within these regions, each country has different legal and monetary frameworks. Etherisc engages with local regulators to help create an efficient regulatory environment for blockchain based insurance. Etherisc supports interested parties and helps to guide the coordination process with the relevant agencies and ministries.

The financial and organizational hurdles to establishing a new insurance company are high. For countries like Germany, Etherisc offers a new legal model where the legal claim is exchanged for a technical guarantee using blockchain and smart contracts. Thus, the provider — in this case Etherisc — is no longer subject to an insurance company’s legal and financial requirements. Still, for each project, product and jurisdiction, the legal framework has to be considered and the product owner is responsible for the proper implementation. The Etherisc team has accumulated a lot of experience in this field and is happy to share these insights with platform users.

Technical framework

Developed and maintained by Etherisc, the Generic Insurance Framework (GIF) allows to model, deploy and operate insurance products based on blockchain in a decentralized and transparent way.

Using the GIF, interested parties can quickly implement and securely operate their insurance products.

With the GIF, it is technically possible to model insurance policies individually.

3.3 What is the GIF?

GIF is an acronym and means generic insurance framework. At its core, it consists of a collection of open-source smart contracts that implement generic functions of the lifecycle of insurance products and policies.

| Thus, GIF enables the modeling of a wide variety of insurance types._ |

|---|

Processing steps that run similarly in all products have been identified and made available as modules to design insurance products quickly and easily. Thus, only product-specific aspects, such as pricing, etc., need to be implemented for each product.

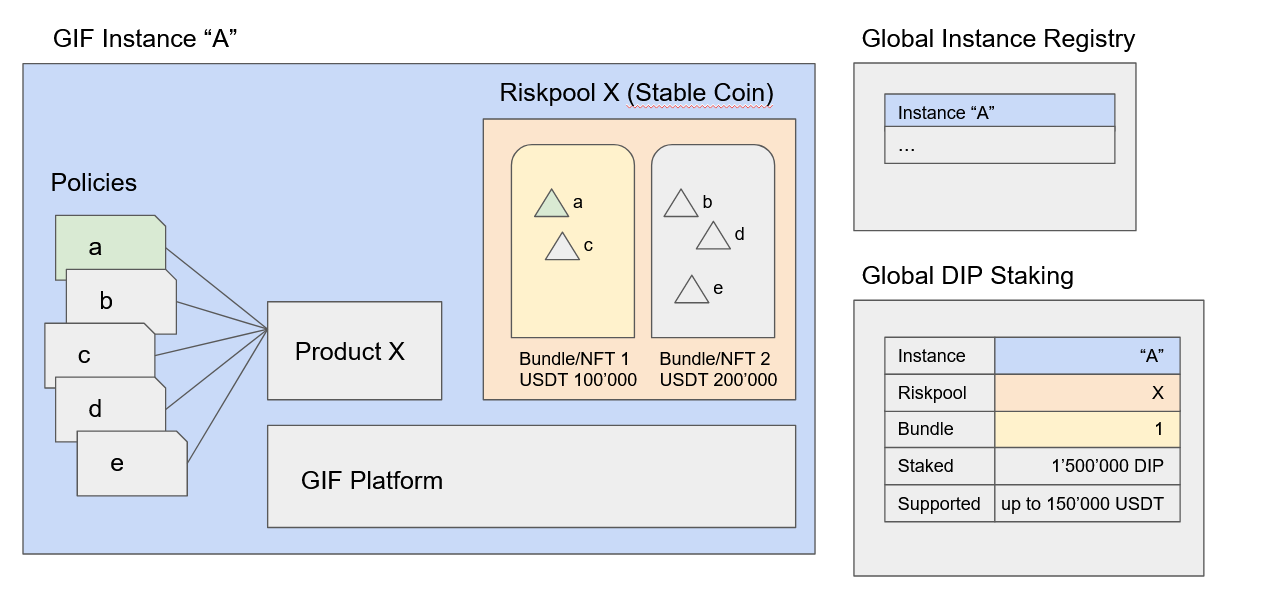

3.3.1 GIF and GIF instances

To operate insurance products, including selling policies, collecting premiums, calculating trigger events and handling payouts, a complete execution environment is needed in addition to the smart contract collections that define products and policies.

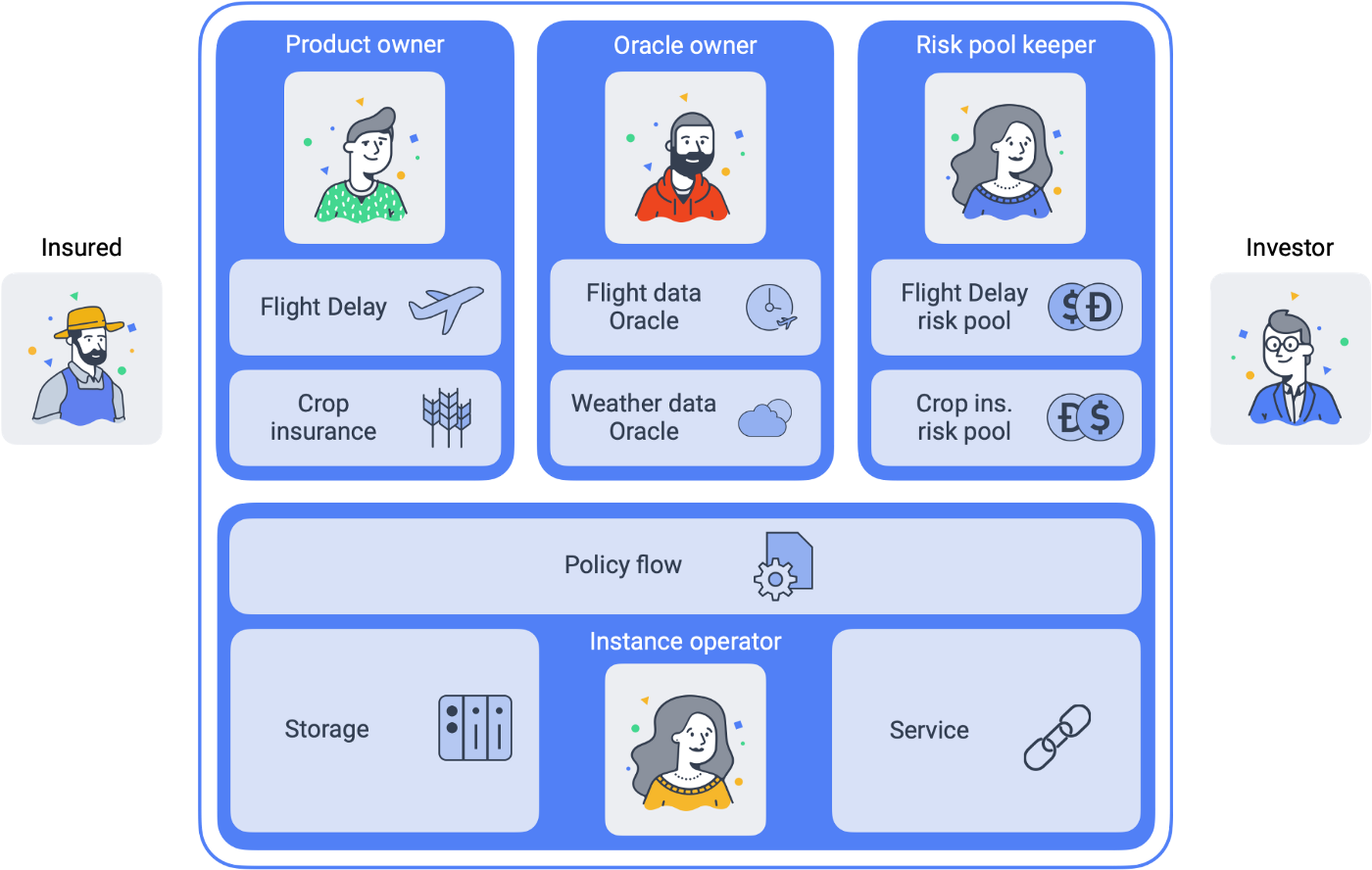

This execution environment — called a GIF instance — may be seen as a comprehensive platform or marketplace in which GIF-based insurance products are managed and operated. Our goal is for a GIF instance to be used by many different and independent providers offering various insurance products. The figure below provides an overview of the stakeholder roles involved with a GIF instance.

3.3.2 Participants on the platform

Insured/Customer

The insured / customer is the policyholder who wants to transfer his risk to the risk pools. Third parties can offer payment gateways and integrations which remove the necessity to own cryptocurrency from the end customer.

Investor

Investors are interested in participating in risk pools to balance/diversify their risk portfolios. Investors provide collateral for risk pools in return for interest payments.

Oracle owner

One of the most promising applications of a decentralized insurance space is the way data is collected and managed. The oracle owner provides oracles that interface between the blockchain smart contracts and external data sources. In the case of flight delay insurance, the oracle informs the smart contract whether the flight landed in time, how much it was delayed or if it was completely canceled.

Product owner

The product owner designs and operates one or more products. This would be an insurance company or an MGA (managing general agent) in the traditional insurance industry. Due to the multi-client capability, a product owner can use all oracles located on the respective platform by the oracle owners.

Risk pool keeper

A risk pool keeper manages one or more risk pools.

| A risk pool is a smart contract that allocates (“pools”) several risks, represented by policy objects, to risk capital. |

|---|

Risk pools collect collateral that risk investors invest. Losses are paid from the risk pool. Therefore, the capital in the pool is at (default) risk. Investors can top up their investments and also withdraw their funds.

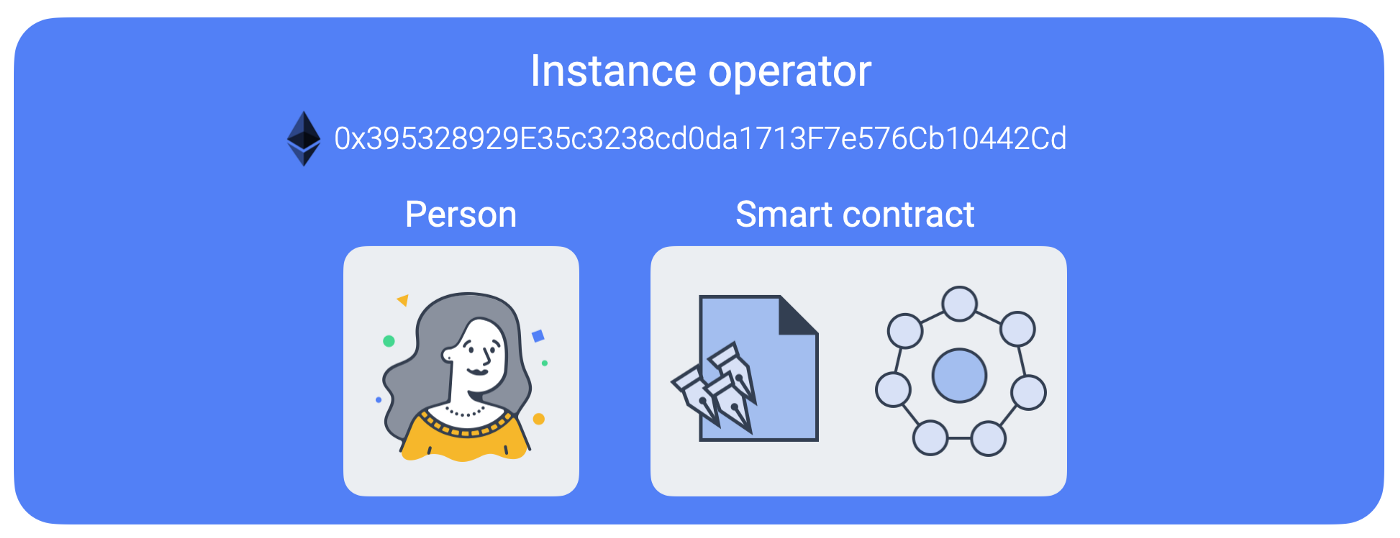

Instance operator

Any complete deployment of a GIF framework is called a “GIF instance.” There will always be at least one complete instance of the GIF operated by the Etherisc project, but in principle, anybody can deploy a new GIF instance. The instance operator is the crucial role that operates a specific GIF instance.

The primary tasks of the instance operator are the administration of products and oracles and a few other basic actions. Any GIF instance is multi-client capable, which means that any number of product owners and oracle providers can be operated and administered on one GIF instance.

The instance operator is represented by an Ethereum address. The instance operator can be a natural person owning the private key of that address or a smart contract — either a multisig or a DAO structure. This enables an entirely decentralized operation of any GIF instance. One address can, of course, manage several independent GIF instances.

It is the declared goal of the Etherisc Project that GIF instances are controlled in a decentralized way - either by multisig or by DAOs with their own governance structure - and that they are controlled by the platform’s stakeholders (customers, product owners, oracle owners and risk pool keepers). In Chapter 5 we discuss how the ecosystem can incentivize this development.

3.4 Generic lifecycle functions in GIF

3.4.1 Concept of components

Each GIF instance manages different components. A component is a specific smart contract with a certain core functionality. The components can represent different core objects.

The core objects are:

-

Products

-

Oracles

-

Risk pools

All components and thus the objects they contain can assume identical states and have the same life cycle but can differ significantly in terms of lifespan.

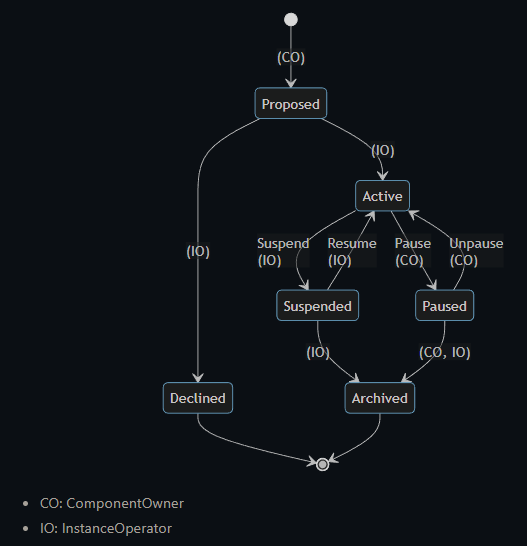

3.4.2 Component roles and lifecycle

Two roles can determine the life cycle of a component.

Component owner

A Component owner can be an oracle owner, a product owner, or a risk pool keeper, depending on which core object he manages.

Instance operator

The instance operator runs one or more GIF instances.

A component in the GIF is always in one of the following states:

-

Created

-

Proposed

-

Declined

-

Active

-

Paused

-

Suspended

-

Archived

The transition between these states and the roles which those can be triggered by are described in the above diagram. The lifecycle of a component starts with its development and deployment on the blockchain. The component owner can implement their specific requirements in the component’s smart contract or use the generic functionality of the GIF components. In the next step, the component is registered, approved and activated by the instance operator in the GIF instance. The instance operator can also decline a component. The component is then deleted.

In the event of approval, the instance operator continues to check the technical and procedural details. The instance operator can also outsource the verification to an independent audit.

| Another condition is that the component owner must contribute a certain amount of DIP tokens to be allowed to operate in the GIF instance. |

|---|

If the component is active, it can be used until it is set to either suspended or paused. The difference between suspended and paused is that only the instance operator can suspend a component or resume it from suspended to active. The component owner can set a component to paused, the component owner and the instance operator can unpause the component. If the component is inactivated (pause, suspended) and not reactivated (resume, unpause), it is not deleted but archived.

For each type of component (products, oracles, risk pools) we provide sample implementations which can be used as a starting point.

3.4.3 Policy lifecycle

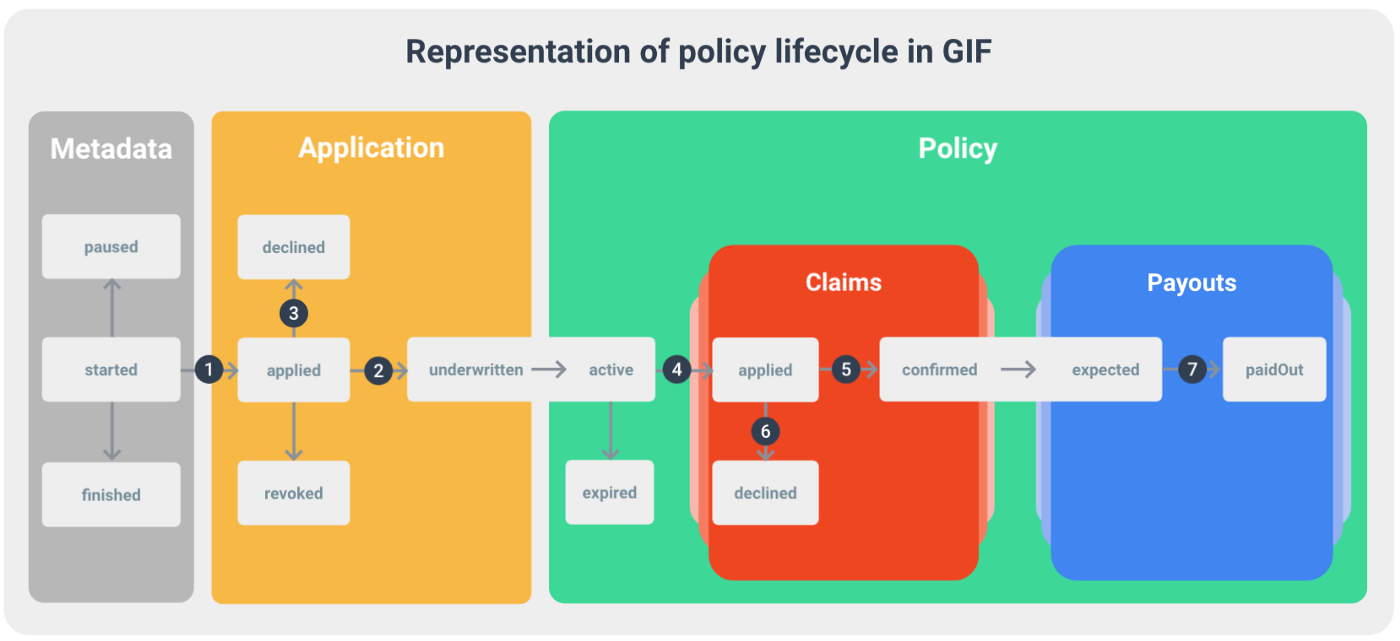

Independent of the specific product, each policy processed on the GIF instance has a lifecycle. Typically, a policy undergoes several state changes during the lifecycle. While any product designer could implement his own lifecycle (in our terminology, the life cycle is called “PolicyFlow”), the GIF offers a default lifecycle which should be sufficient for most use cases. This generic life cycle is called “PolicyFlowDefault.”

The “PolicyFlowDefault” lifecycle offers the following functions:

-

newApplication (to generate and store a new application from a customer)

-

underwrite (to sign an application and create a new policy)

-

decline (to reject an application)

-

newClaim (to generate and store a new claim in case of loss)

-

confirmClaim (to confirm a claim and create a payout)

-

declineClaim (to reject a claim)

-

payout (to confirm and initiate a payout)

3.4.4 Payments

The GIF instance is agnostic to the way payments are made. Pure crypto payments can be made directly to the product contract, while fiat payments need a fiat gateway and an external banking or credit card infrastructure. The core team can request information on how to implement fiat gateways.

3.5 Introducing the GIF monitor

The GIF system is entirely transparent for blockchain experts, but it can be difficult for non-blockchain experts to understand.

| That’s why we developed the GIF monitor to give everyone an overview of what’s happening on the blockchain of a GIF instance. |

|---|

3.5.1 What is the GIF monitor?

The GIF monitor provides a structured overview of all generic building blocks available in the GIF framework for creating and operating an insurance product. You can view all events and business transactions of the complete instance.

The GIF monitor provides all this information transparently and in real-time online. The information is read from the blockchain and the GIF framework.

3.5.2 Menu items

The URL https://gif-monitor.etherisc.com/ takes you to the ‘Home’ area of the GIF monitor. In the menu bar, you can choose from the following menu items.

In the ‘Home’ area you can click directly on the menu items in the menu bar and then select the corresponding menu item in the drop-down menu.

Core

The ‘Core’ area is by far the most extensive area. It displays the available GIF instances, the GIF core contracts per instance and the events of these core contracts. The core area shows the complete core contracts that each user can use.

Here you find the blockchains the instances use, such as xDai or Ethereum. By clicking on an instance, you will get detailed information like the instance ID, name, name of the blockchain, chain ID and status (active or not). Each instance is identified by its registry address. GIF is multi-chain capable and can run on all significant Ethereum-similar blockchains.

In this section you will find all 14 GIF core (smart) contracts. Each core contract provides essential functionality to a GIF Instance.

You can click on the contract name for all GIF core contracts to get to the contract details. Here you will see on which instance you are, the instance ID, the address on the blockchain, the name of the core contract, and the detailed contract functionality as described by its contract application binary (ABI) interface.

Here the contract events of the GIF core contracts are displayed.

Contract events are emitted by smart contracts during code execution and permanently stored on the chain. Events are primarily used to document significant changes in the data of the smart contracts, for example the change of status.

Oracles

The available oracles are displayed in the ‘Oracle’ area of the GIF monitor.

On this page, you will find all oracles available on the platform. Here you can view all input and callback formats as a product owner. In addition, the appropriate oracle can be requested from the Oracle owners.

By clicking on an oracle, the GIF monitor displays the details. Of course, individual oracles can also be implemented on request.

Products

In the ‘Products’ area, all products are listed that have been created in the framework. By clicking on a product, the details are displayed.

Policies

In the ‘policies’ area you can find information on every phase of the life cycle of a policy. Starting with information about the product, metadata, application, policy, claim and payout. Depending on the policy’s life cycle, more or fewer information blocks are displayed.

4 Tokenizing Insurance

You can tokenize almost anything. Some things make less sense than others. We are convinced insurance is an increasingly hot topic around tokenization.

4.1 The DIP Token

The acronym “DIP” stands for the “Decentralized Insurance Protocol” and the “Decentralized Insurance Platform”. DIP is the native token of Etherisc issued by the 'Decentralized Insurance Foundation' (DIF) based in Zug/Switzerland.

During the Etherisc DIP TGE (Token Generating Event), DIP tokens have been created on the public Ethereum mainnet. We preferred using this term over “ICO'' or “token sale.”

Quick facts about the Etherisc DIP TGE

-

Hardcap: 30 Million USD

-

Total Supply: 1 Billion (10^9)DIP

-

Tokens distributed to early investors and during TGE: 300M DIP (= 30% of total supply)

-

TGE price: 1 DIP = 0,10 USD

-

Only registered contributors were able to participate in the Etherisc DIP TGE.

Participants (not customers) need tokens to join the platform’s "ecosystem." As a rule of thumb, everybody who wants to use the platform to earn money, will need to own and stake a certain number of DIP tokens. These DIP tokens remain in the ownership of the participant, and will be reimbursed if the participant intends to leave the platform - albeit with a certain notice period.

Depending on the service offered, a different number of tokens are required to use the platform or offer services on the platform. Simple services require a small number of tokens, while complex or critical services require more tokens. The amount of tokens that must be provided as stake depends on the potential damage caused by participant misconduct or violation of the platform terms. The staking of DIP tokens is different from the staking of assets in risk pools, which we will discuss below.

Staked DIP tokens can be “slashed” in case of bad behavior, e.g. violation of certain terms or requirements. The slashing rules will be published on the Etherisc website.

In the future, these rules and parameters will be the basis for controlling the platform. The DIP token serves as collateral and a representation of the network’s tangible and intangible value similar to the way financial resources serve to secure operating resources in a cooperative.

4.2 The Etherisc Staking Model

| Staking is still in beta - please expect that the Etherisc Staking Model may undergo substantial changes in the near future! |

|---|

In the Etherisc ecosystem, staking comes in two different flavors:

-

The first type of staking is staking of DIP tokens in a “Global Staking Pool”. The first type of staking ensures that participants who earn money using the platform have “skin in the game”, and also ensures that participants are economically incentivized to behave compliant to the platform rules.

-

The second type of staking is staking of crypto assets, typically stablecoins, in risk pools. These assets carry the insurance risk.

4.2.1 Staking for Risk Pools

When you buy an insurance policy, you expect a payout in the event of a claim. To ensure that there is always enough liquidity to start or continue selling policies and to service all payouts, we plan to set up a system with two corresponding risk pools.

The two corresponding risk pools will collect premiums for all policies sold and additional liquidity provided by investors. Each well-designed risk pool is subject to an actuarial model for the insured risk and thus determines a certain probability of default for each policy.

We define staking in the decentralized insurance context as:

| _"The process of attracting and binding capital from investors to specific risk pools to cover their tail risks." _ |

|---|

Net premiums (after deduction of costs) from the purchase of policies are paid into the risk pool, and claims are covered from the funds of the risk pool. An investor chooses an investment option based on risk tolerance and portfolio structure.

Alternatively, the investor selects his investment according to ethical aspects such as environmental friendliness, climate neutrality, or social commitment. If necessary, he accepts a lower profit to offer insurance to small farmers, for example. We will always encourage the implementation of green & fair products on the GIF!

4.2.2 Trustless Risk Pools

For a trustless risk pool to function, methods must be implemented that technically and transparently guarantee that the interests of both the insured and investors are met. For the insured, this means that we can prove that the risk pool will always be able to fulfill claims.

For investors, this means they receive a fair share of the profits made and can decide for which risks they will engage with their funds. This results in the need for the system to run entirely on the blockchain. On blockchain, computation is expensive, so we need to keep these calculations efficient. To achieve this goal, we plan to implement "epochs" into our risk pools. The duration of an epoch will depend on the product. For each epoch, all policies sold will be treated the same. This step reduces the complexity massively.

4.2.3 The basic idea of risk pools and rewards in insurance

The core economic process of insurance, the transfer of risk between insureds and investors, is implemented in the GIF framework through risk pools.

While the standard risk pool template includes all the core functions for processing premiums, claims, deposits, payouts, and returns, the template leaves maximum flexibility for risk pool keepers to design their pool’s economic model to appeal to insureds, product owners, and investors.

4.2.4 Core functions of a risk pool

-

Receive premiums in the form of native tokens or stable coins.

-

Receive investment deposits in stable coins or tokens as specified by the risk pool keeper and the product owner.

-

Manage investment deposits. An investor must have insight into the status of his investment at any time.

-

Payout claims in case of loss.

-

Processing investment withdrawals. This mechanism is designed so that the risk capital can be paid out only when it no longer serves as a security of concluded policies.

-

Process profit distribution. A significant part of the paid premiums is distributed as profit to the investors depending on the investment amount, the period of the deposit and the risk taken.

-

Autonomous control of risk pool parameters. The size of risk pools depends on the demand for the underlying product. We will provide mechanisms that allow autonomous control of risk pool parameters.

4.3 Implementation of Risk Pools in the GIF

The standard risk pools will initially consist of a primary risk pool (PRP). Optionally, secondary risk pools (SRP) can be created. This combination of two risk pools provides complete flexibility for insurance products and investors.

4.3.1 Primary Risk Pools (PRP)

The primary risk pools (PRP) will receive the net premiums (i.e. gross premiums minus costs) paid by insurers in stablecoins (e.g. USDC, in this example, or xDai at Flight Delay). in exchange for assets staked by the investor The PRP will generate risk pool NFTs.

An investor will not transfer his DIP token directly into the PRP but into the SRP. The deposited DIP tokens are collected and transferred to the PRP at the end of an epoch, and the PRP generates a new risk pool NFT; the owner is the SRP. The investor receives the equivalent value of his deposited DIP tokens in risk pool tokens (RPT) minted by the SRP.

The global staking pool will span all primary risk pools of a GIF instance. Comparable to reinsurance, the pool steps in if, for example, black swan events lead to the insolvency of a primary risk pool, then the parachute pool steps in. Investors can also stake their tokens and stable coins in the global staking pool.

4.3.2 Risk pool token

If the investor stakes assets in the primary risk pool, he receives a risk pool NFT as a receipt. While NFTs are tradeable in principle, we expect the risk pool NFTs to be illiquid. To facilitate trading of risks, we will introduce fungible risk pool tokens (RPT) via so-called “Secondary Risk Pools”. A secondary risk pool will acquire the risk pool NFTs of the primary risk pool and fractionalize it. Investors can invest in a secondary risk pool and will receive fungible (ERC-20) risk pool tokens in proportion to his share in the secondary risk pool. New risk pool tokens are minted when new capital is deposited into the pool. For each pool, specific RPT are minted.

4.3.3 Risk pool NFT

The NFTs are linked to a specific PRP and cover risks of individual insurance policies. The NFTs remain in the SRP and the RPTs in the investors' wallets. When all policies linked to an NFT are expired and all associated claims have been paid out the investor can withdraw all assets associated with the NFT.

4.3.4 Why Epochs?

We want investors to deposit and terminate as quickly and efficiently as possible. But the protection of other investors and policyholders is also essential to us. So we have found a compromise that benefits all parties, the Epochs.Epochs massively reduce computational complexity, a limiting factor in smart contracts due to blocking gas limits. The epoch concept can execute every transaction with a fixed gas cap.

4.3.5 Single-sided/double-sided/multi-sided staking

In the first release of our risk pool, we will offer single-sided staking only (the risk is taken by a stablecoin only). However, you need to stake a certain amount of DIP tokens in the Global Staking Pool, in relation to the capital invested. So only when you have staked the base amount in DIP tokens can you contribute risk capital in the form stablecoins. In the future, investors will be able to stake different assets - not only stablecoins - depending on the requirements of the risk pool keeper in the risk pools.

4.3.6 Credit rewards and payment losses

The standard offered by the generic insurance framework is simple. Premiums are added to the risk pool (after deducting costs) and increase the value of the risk pool tokens. Payouts are paid from the pool and decrease the value of the risk pool tokens.

In the standard implementation, profits initially remain in the pool. Profits are realized the moment capital can be withdrawn from the pool.

Investors receive their premiums in the epoch in which the contract is concluded. The premiums paid by policyholders are credited proportionately in the ratio of personal risk capital / total risk capital. Any refunds in the event of a claim are shared proportionally by all risk capital providers who have contributed to the premiums since the policy’s inception.

So if you have two investors, investor 1 has DIP 100,000 staked, investor 2 has DIP 50,000 staked. Insurance is taken out with a premium of USDC 30. Investor 1 receives the equivalent of 20 USDC through the price gain of his RPT, Investor 2 receives the equivalent of 10 USDC. The USDC remain in the PRP.

If a claim is then made at USDC 90 on that policy, the USDC 90 will be paid out of the PRP. Investor 1 loses the equivalent of 60 USDC, Investor 2 loses the equivalent of 30 USDC.

5 Etherisc Governance Model (EGM)

5.1 Abstract

-

The purpose of the Etherisc Governance Model (EGM) is to create an effective self-regulatory mechanism for the Etherisc ecosystem. Etherisc considers a baseline of rules and procedures as necessary to ensure that:

-

The platform operates in a way that is consistent with the rules and recommendations of the Decentralized Insurance Platform (DIP) protocol.

-

Participants of the platform conduct business in the interest of the good of the commons, while safeguarding the interests of customers and investors.

-

Market integrity is preserved, meaning no market abuse and all platform participants have equal access to accurate and transparent information.

-

-

Consistent with a decentralized infrastructure, regulation should be carried out by the community rather than a sole entity. Additionally, rules need to be enforceable to incentivise compliance. For rules to be enforceable, there needs to be an element of staking.

-

Beyond a smooth-functioning ecosystem being an end in itself, the EGM will be instrumental to strengthening confidence in the Etherisc decentralized insurance platform and support growth and massive adoption.

5.2 Core Values

Any system of rules requires a set of underlying principles and “values”. Both the set and the meaning of these values is necessarily to a certain extent fuzzy and cannot be fully captured by any formal definition.

Some people would e.g. emphasize other values not listed here, or put it in different words. However, these rules have been proven to be helpful in other contexts which rely on decentralization and collaboration.

They serve as general guidelines to derive more precisely defined rules and requirements.

-

Respect

Each platform user, actor, stakeholder should respect and value diversity. We promote inclusiveness and treat others with tact, courtesy and respect. We abstain from and actively discourage discrimination in all forms. -

Collaboration

The Decentralized Insurance Platform is based on strong, voluntary partnerships. The Platform will always encourage partnerships and cooperation. Each participant should be able to benefit from evolving partnerships. -

Responsibility

Each participant shall act fully on his/her own responsibility, while the platform will provide any means to support this. All participants acknowledge their joint responsibility for the operations and development of the platform as a whole. -

Trust

The platform encourages trustful behavior and will provide a safe environment for all participants. Each participant is committed to compliant behavior. Transparency is an important element in trust-building, therefore we encourage transparency as much as possible, without violating the justified needs for protection of each participant of the platform. -

Public good / Commons

The platform as a whole serves the public good. It is a “commons”[13] in the sense of Elinor Ostrom and operated by the community of all participants. Therefore, the governance rules for the platform are based on the eight rules for successful commons, coined by E. Ostrom. In chapter 5, we discuss how the “eight rules” are implemented in the EGM and DIP Protocol.

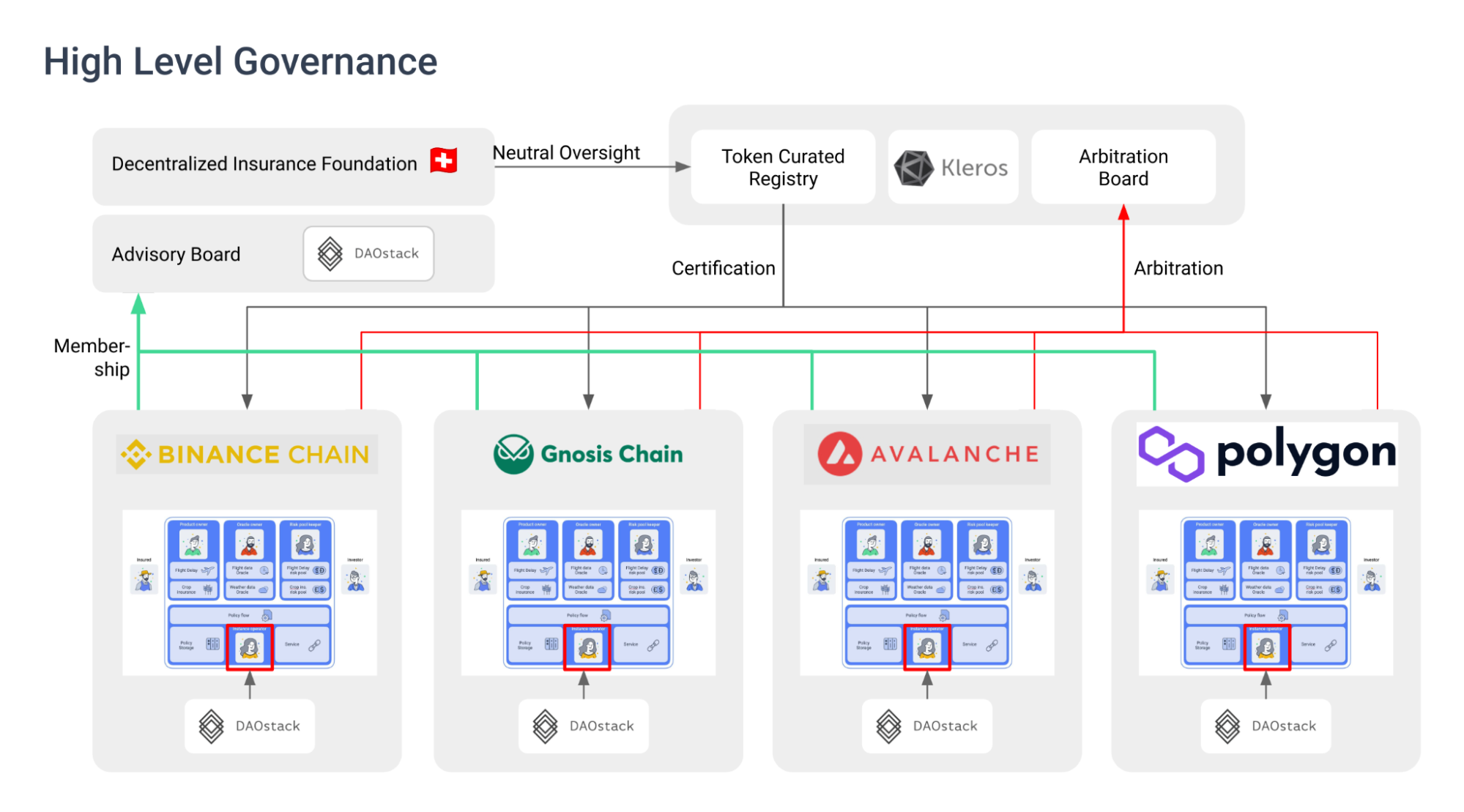

5.3 High Level Structure of the EGM

In the image below a number of actors/participants are mentioned, the names mentioned are written as an example and it may be that other actors and/or blockchains are added. In this image the following players are mentioned.

| Name | Short description |

|---|---|

Decentralized Insurance Foundation |

Development and promotion of the DIP protocol, funding of the development of the Generic Insurance Framework (GIF) |

Kleros |

Decentralized arbitration service and token curated registry |

DAOstack |

Software stack for DAOs including a library of governance protocols and interfaces for creating and managing DAOs |

Mainnet |

Example blockchain |

Gnosis chain |

Example blockchain |

Avalanche |

Example blockchain |

Polygon |

Example blockchain |

-

The four defining aspects of the EGM are as follows:

-

Platform participants as the topmost authority

-

The Decentralized Insurance Foundation as the non-profit, neutral link to the real-world institutions and legal systems

-

Certification of GIF instances as a market signaling mechanism to incentivise high standard of work

-

Dispute resolution via an independent arbitration board

-

-

The participants of the platform - be it insureds, product builders, or investors - are the topmost authority of the platform. Their stake is represented by governance tokens (vDIP), which are minted against staking DIP tokens in a governance contract. Governance tokens (vDIP) are used for decision making in all DAOs involved in the platform.

-

While the participants of the platform are represented by addresses on blockchain protocols, we need a link to the real world connecting the on-chain infrastructure with legal entities in the real world.

-

In the real world (“IRL”), the topmost authority is the not-for-profit Decentralized Insurance Foundation (DIF), based in Zug, Switzerland, and regulated according to Swiss Law.

-

The purpose of the DIF is defined in the notarial deed of the Foundation and cannot be changed:

| “The Foundation’s purpose is promoting and developing new technologies and applications, especially in the fields of new open and decentralized software architectures mainly in the insurance field. A dominating but not exclusive focus is set on the promotion and development of the so-called DIP-protocol and the related technologies, as well as the promotion and support of applications using the DIP-protocol.” |

|---|

-

Therefore, the only purpose of the Foundation is to serve the community of participants in building and using the DIP protocol.

-

The DIF is committed to strict neutrality. Therefore, the DIF will never engage in disputes between participants. For dispute resolution, the DIP Platform will use existing mechanisms like e.g. the Kleros arbitration board.

-

The DIF is formally represented by the Foundation Council.

-

The main task of the DIF in the context of the technical DIP Protocol is the certification of GIF Instances on the different blockchains. On each blockchain, there can be multiple GIF Instances. The rules for certification will be published. The rules should be such that, if possible, there is no ambiguity in interpretation and that people with basic technical understanding and common sense can make a decision whether a particular GIF Instance meets the requirements. Requirements include technical stability (like contract audits) and soundness, as well as legal compliance. Certified GIF Instances are registered in a Token Curated Registry. The concrete rules for certification of GIF Instances are currently work in progress.

-

Certification has no specific consequences - it’s just signaling “this GIF Instance has undergone thorough scrutiny and due diligence and it implements the rules and recommendations of the DIP Protocol”. Thus, we expect that a certification will act as a strong differentiator in the market and non-certification will essentially be a “red flag” for both customers and investors. This is how self-regulation works. However, in the future, other parties outside the DIP ecosystem could link access to certain services to valid certificates.

-

Each GIF Instance is operated by an Instance Operator. An instance operator can be represented by an EOA (externally owned address), a multisig, or a DAO. It is recommended that the Instance Operator is represented by a DAO, the members of which are the stakeholders of this GIF Instance.

-

Each GIF Instance may send a delegate in the Advisory Board of the DIF. The advisory board shall interact with the Foundation Council and represent the interests of the GIF Instances and its stakeholders with the Foundation Council. The advisory board and its decision-making processes are implemented as a DAO.

-

Each GIF Instance (or the DAO representing it) can implement governance rules on a more granular level, e.g. rules to decide which products may be listed on the instance and which not, as long as these rules are in accordance with our core values and the other rules of the platform.

-

Each GIF Instance needs to implement rules which ensure that the instance is able to participate in the funding of the EGM and the DIP protocol in general.

-

Disputes are resolved via an arbitration board. Possible disputes include e.g. registration of a GIF Instance in the TCR, or disputes in relation of insurance claims which cannot be resolved via smart contract logic (e.g. oracle malfunction).

5.4 Funding of the EGM and the DIP Protocol

-

The infrastructure to maintain the EGM, as well as the development and maintenance of DIP protocol (especially the development and maintenance of the GIF Framework) requires funding.

-

The funding is intended to only cover costs, to be self-sustaining and not profit-oriented.

-

Each GIF Instance will therefore be required to:

-

Stake a defined amount of DIP tokens in a governance staking contract

-

Pay a regular fee to cover the operational cost of the EGM

-

-

The required amount of stakes and fees are calculated based on the economic volume which is transacted on the particular instance. The exact scheme will be published in time.

-

In case of violation of rules, sanctions of different severity can be applied to misbehaving participants:

-

Financial penalties for misbehaving members

-

Slashing of staked DIP tokens

-

Exclusion of participants from a GIF Instance

-

Exclusion of a GIF Instance from the Token Curated Registry.

-

-

Part of the fees paid will be burned to create a slight deflationary effect on the DIP token.

5.5 Global Staking Pool

-

The DIF will maintain a global staking pool (GSP). The GSP will be deployed on the Ethereum Mainnet.

-

The GSP has the following objectives:

-

Provide an economic incentive for well-behavior

-

Provide a “sink” which will bind DIP tokens

-

Ensure that participants which profit from the Etherisc ecosystem, have “skin in the game” and aligned interests with the whole system.

-

-

Participants in the Etherisc ecosystem are expected to stake and lock a certain amount of DIP tokens in the GSP:

-

GIF Instance operators need to stake and lock tokens for each certified GIF Instance

-

Product owners need to stake and lock tokens for each product deployed and approved on a certified GIF Instance.

-

Oracle providers need to stake and lock tokens for each oracle deployed and approved on a certified GIF Instance.

-

Risk Pool Keepers need to stake and lock tokens for each risk pool deployed and approved on a certified GIF Instance.

-

Staking in the GSP is independent from staking in Risk Pools. Investors can stake in Risk Pools without having staked in the GSP, and the rules defined in this chapter do not apply to staking investors.

-

-

The amount to be staked and locked for each group of participants will be published on the Etherisc Website.

-

The amount to be staked and locked will correlate with the economic value which is created by the participant. The exact KPIs to be considered and the formulas to calculate the amount of DIP tokens to be staked will be published on the Etherisc website.

-

Tokens staked in the GSP can be locked by the stakers for different purposes:

-

For a GIF Instance (necessary for operation of a GIF Instance)

-

For a product (necessary for operation of a product)

-

For an oracle (necessary for operation of an oracle)

-

For a risk pool (necessary for operation of a risk pool)

-

For specific governance purposes (optional, to participate in specific governance decisions)

-

-

For each purpose, there is a “Lock Manager” who has the power to lock or unlock tokens. Initially, the lock managers are controlled by a multisig owned by the Foundation Council of the Decentralized Insurance Foundation. After a testing period, the control on the lock managers may be transferred to the DAO associated with the Decentralized Insurance Foundation.

-

Each participant who has staked and locked DIP tokens will be granted general voting rights in the Etherisc Governance Model. For specific purposes, there may be the requirement to additional stake and lock tokens in a governance lock manager. For each governance decision, the voting rights are calculated on a snapshot of the GSP at a certain block height.

-

Voting is performed byhttps://snapshot.org/#/[ Snapshot voting] using a strategy which reads the locked tokens out of the GSP at a certain block height.

-

The code of the GSP is published in the global staking repo in the etherisc github.

5.6 Monetary policy of the DIF

-