Basics about the GIF framework

Introduction

Welcome to our tutorial about the Generic Insurance Framework (GIF). We would like to take you step by step to the topic of insurance in general and how to model insurance with the generic insurance framework.

First we will establish some definitions, functions and roles in order to have a common domain-oriented basis.

What is insurance?

Insurance is a means of protection from financial loss. It is a form of risk management primarily used to hedge against a contingent or uncertain loss risk. The loss associated with the risk may or may not be financial, but it must be reducible to financial terms.

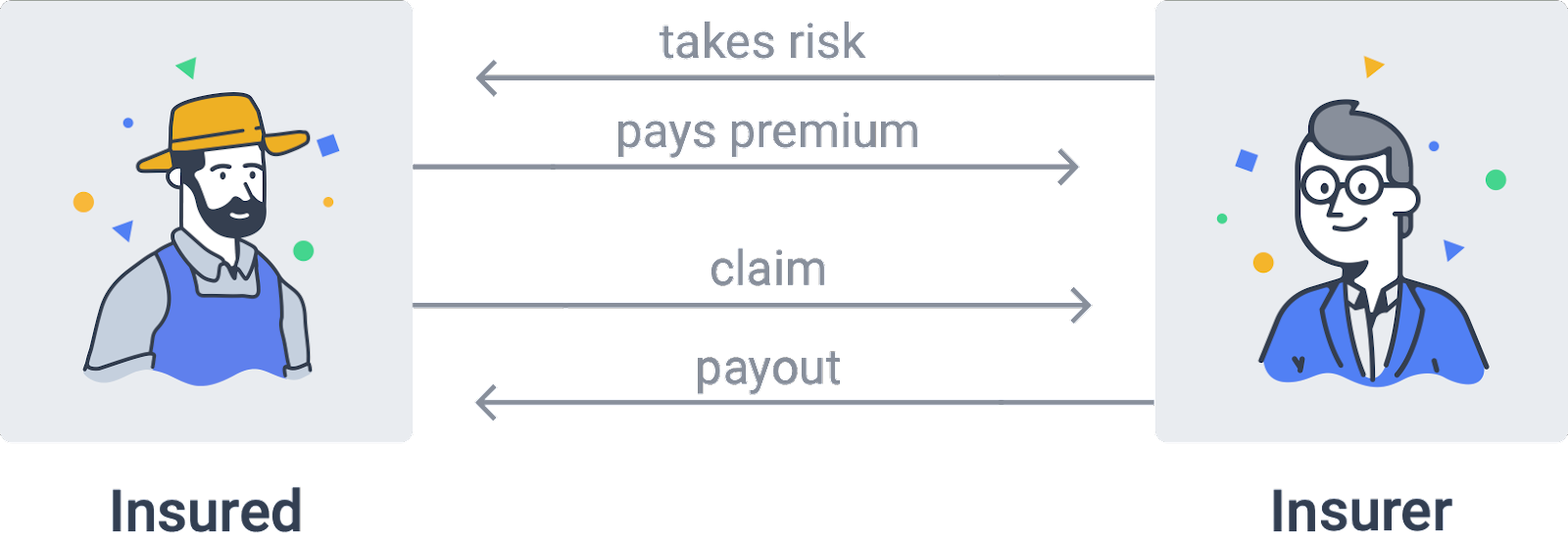

An insurance company takes over risks from a customer, often called the insured. Insurable risks can be events related to weather, like too much or too little rain, but also the delay of a booked flight or a classic car liability insurance. The insurance promises to compensate the insured in case of a covered loss. In return, the insured (also the policyholder) pays a premium. The insurance creates a payout to reimburse the agreed financial amount if a claim occurs.

The insurance company can outsource all services, such as sales or data management, to other service providers. The only exception is the fundamental assumption of the risk. This risk must always remain with the insurance company.

The exact legal requirements for insurance vary around the world. In most countries, an insurance company requires a state-issued license.

What is an insurance policy?

An insurance policy is the contract provided by the insurance to the insured that details conditions and circumstances under which the insurance makes payouts to cover the insured losses that occurred from accepted claims.

Let’s look at the lifecycle of a typical insurance policy. Such a lifecycle usually consists of the following chronologically listed sub-steps.

-

The customer inquires about an insurance policy. By taking out the insurance policy, one wants to protect oneself against a specific risk.

-

The insurance company examines the customer’s application.

-

The application is accepted or rejected.

-

In case of rejection, the customer is informed, no further activities occur.

-

In case of acceptance, the contract comes to the "underwriter". The acceptance of the application is called "underwriting".

-

The insurance company commits itself with the “underwriting” to take over the customer’s risk and transfer it to itself. It further undertakes to cover the loss if the insured event occurs.

-

The customer, for his part, undertakes to pay the premium.

-

Both declarations of obligation are documented in a contract. This contract is called the insurance policy.

-

If a claim occurs, the customer reports it to the insurance company.

-

The claim is checked by the insurance company and accepted or rejected.

-

In case of acceptance, the agreed insurance sum is paid out.

At this point, it is easy to see that the insurance business triggers a substantial amount of record-keeping. Many of the individual sub-steps in the classic insurance business require manual activities. For example, when a customer makes a claim, the insurance company has to check the details of the claim manually. This involves a lot of effort and thus incurring costs.

What is parametric insurance?

Parametric insurances cover the occurrence of predefined events instead of indemnifying actual losses incurred.

Parametric insurance policies correspond to agreements between the insurance and the insured where the insurance approves payouts to the insured when predefined triggering events occur.

In parametric insurance, loss events (the risks) are defined as functions of underlying indices or parameters that meet the criteria defined by the insurance product. Example indices/parameters include rainfall amounts and wind speeds for insurance linked to weather conditions. In the case of flight delay insurance, the parameter/index can directly be derived from the difference between the actual arrival time and the scheduled arrival time of an insured flight. To make parametric insurance feasible and attractive to all parties, the underlying indices/parameters must be transparent, reliable and trusted.

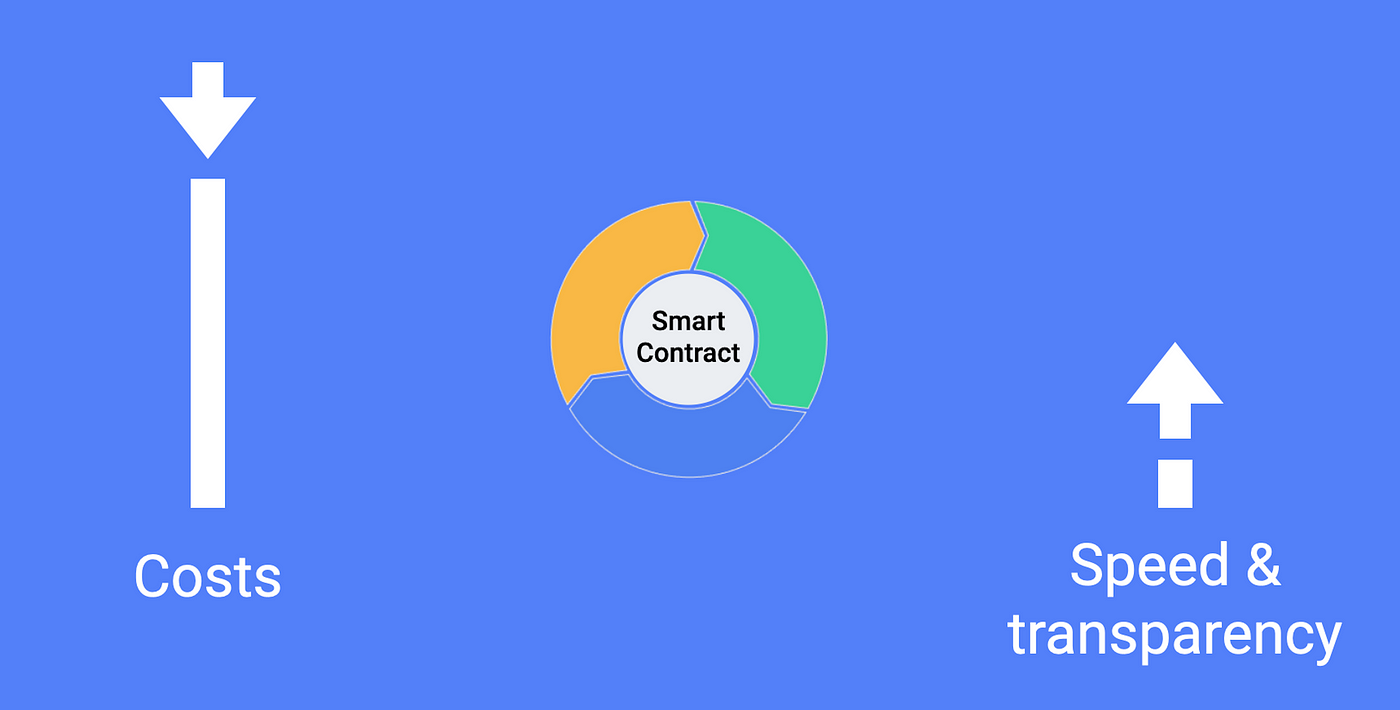

Once such events occur, the insurance may directly calculate and trigger a payout to the insured without an often costly claims acceptance process.

The big win of parametric insurance is their potential for efficiency and automation. Claims handling, one of the most complex and costly parts of the operation of an insurance business, can be reduced to a simple and fully automated process.

What are the advantages of blockchain in insurance?

There are many benefits that blockchain technology may provide to the insurance domain. Some of the advantages are directly linked to the foundations of blockchain technology.

-

Transparency and accountability for records keeping. Information regarding policies, claims and payouts may be stored on-chain. Once on the chain, they can only be deleted or changed with proper permission, and each time data is updated or adjusted, the original data is kept in the history. This means a complete audit trail is available and transparent for all data. This is a clear security aspect and provides value to inexperienced customers with the insurance business and low trust levels towards financial organizations.

-

Minimize friction and transaction costs for payment handling. On-chain handling of premium payments and claims payouts may be a substantial efficiency boost for the operation of an insurance business.

-

Create new markets/opportunities by opening risk pools. The transparent pooling of large numbers of insurance policies of a particular type provides the opportunity to open up this market to a wider audience. Participating in such risk pools allows investors to diversify their risk portfolios.

Blockchain technology may provide additional value for the particular case of parametric insurance.

-

Transparent and trusted handling of indices/parameters. Providing this central data in a trusted way to the blockchain world may be managed through oracle services, which makes it very hard/too costly to feed manipulated index/parameter information into smart contracts implementing parametric insurance policies.

-

Huge efficiency gains with fully automated policies. Once the index/parameter feed is provided reliably to policy contract claims, payout handling may be fully automated for parametric insurance.

-

Immediate payouts. Running in a blockchain context and having automated claims/payout handling allows for near-real-time payouts, as no intermediate financial layers need to be considered.

The Etherisc model

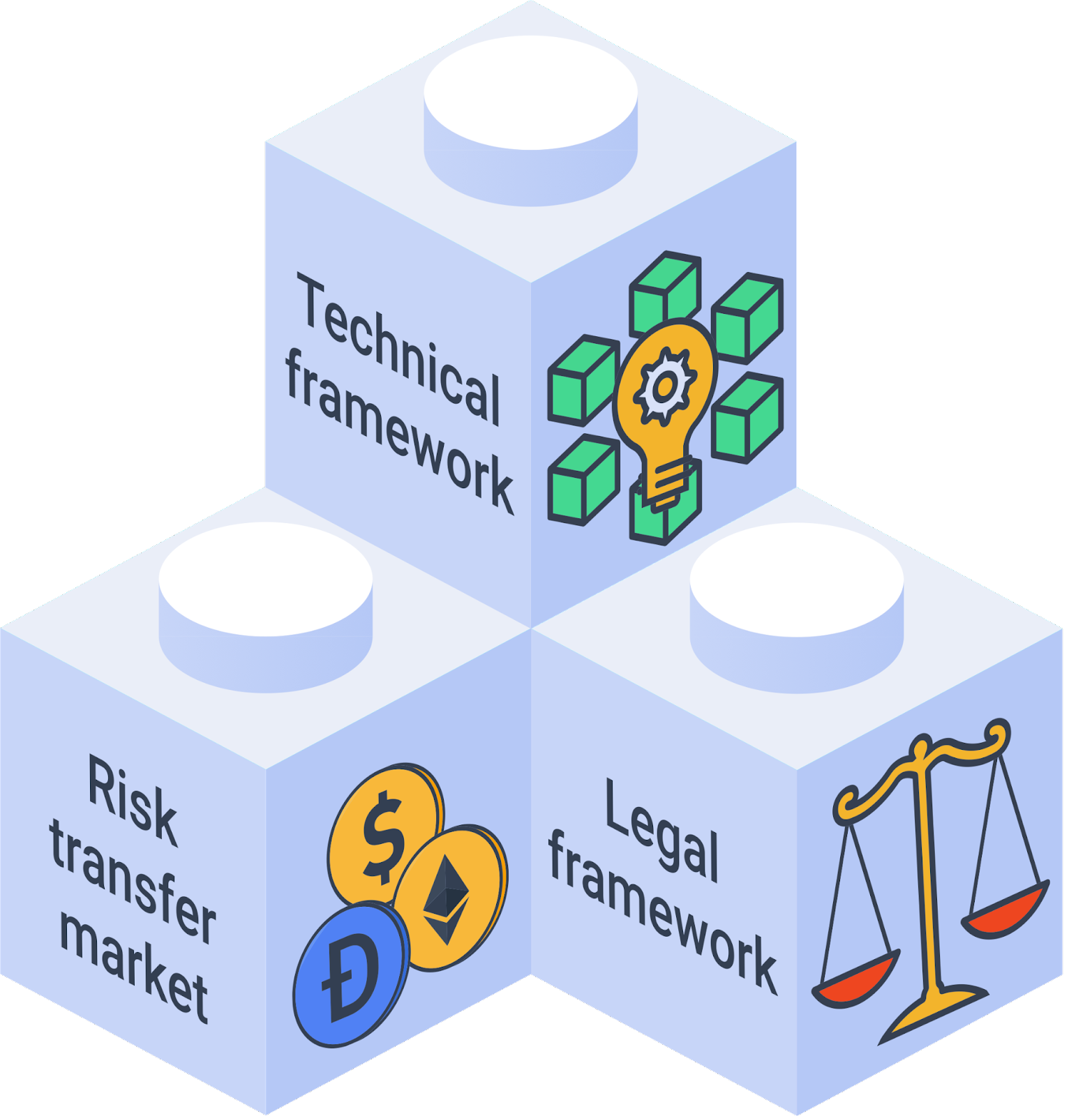

In general, the Etherisc ecosystem is based on three pillars. Risk transfer market, regulatory framework and technical framework.

With the generic insurance framework (GIF) it is possible to model insurance policies individually.

In each country, the legal and monetary frameworks differ from slightly until to seriously different. Etherisc relies on cooperation with local teams and offers its own insurance policies to a limited extent. Etherisc can support interested parties and help to guide the coordination process with the relevant agencies and ministries.

In the paragraphs below the pillars risk transfer market, legal framework and technical framework are introduced individually.

The three pillars of the Etherisc ecosystem

Risk transfer market

Raising capital to back the technical guarantees is done by investors. In other words, they are risk capital providers. In this process, investors will lock a certain amount of DIP token - also known as “staking."The staked DIP token are a prerequisite to investing the actual risk capital in DIP or stablecoins. This cryptocurrency is built in a way that it has a stable economic value, e.g., by pegging it to a fiat currency like USD. What is the reason for this? The community of DIP token holders created the entire Etherisc ecosystem. Therefore, we will demand that parties who profit from the ecosystem also own a share by owning and staking DIP token. This idea is borrowed from the space of cooperative enterprises. It reflects that the Etherisc ecosystem is a public good that must be protected from the “tragedy of the commons.”

Legal framework

Insurance companies are highly regulated worldwide for good reasons, to protect customers as well as investors. Regulation ensures, for example, that the policyholder receives the promised compensation in the event of an insurance claim. Most countries have enacted a great deal of legislation for this purpose. Concerning jurisdiction, a general distinction can be made between the American, European and Anglo-Saxon regions.

The financial and organizational hurdles to establishing a new insurance company are high. For specific countries like Germany, Etherisc offers a legal model, where the legal claim is exchanged for a technical guarantee using blockchain and smart contracts. Thus, the provider - in this case Etherisc - is no longer subject to an insurance company’s legal and financial requirements. Still, the legal framework has to be considered for each project, product and jurisdiction, and the product owner is responsible for the proper implementation. The Etherisc team has accumulated a lot of experience in this field and is happy to share these insights with platform users.

What is GIF?

GIF is an acronym and means generic insurance framework. At its core, it consists of a collection of open-source smart contracts that implement essential functions of the lifecycle of insurance products and policies. Thus, GIF enables the modeling of a wide variety of insurance types.

It is a basic implementation that can be used to create blockchain-based insurance applications.

In order to be able to design insurance products quickly and easily, processing steps that run similarly in all products have been identified and made available as modules. Thus, only product-specific aspects such as pricing etc. need to be implemented for each product.

GIF provides these generic functions for all sub-steps in the lifecycle of an insurance policy, thus enabling an automated workflow that controls the sequence of processing steps. The following section will describe these functions and how they work in detail.

GIF and GIF instances

As introduced above, the GIF provides the means to model and implement specific insurance products and product-specific policy handling based on open-source smart contracts.

To operate insurance products, including selling policies, collecting premiums, calculating trigger events and handling payouts, a complete execution environment is needed in addition to the smart contract collections that define products and policies.

GIF provides these generic functions for all sub-steps in the lifecycle of an insurance policy, thus enabling an automated workflow that controls the sequence of processing steps. The following section will describe these functions and how they work in detail.

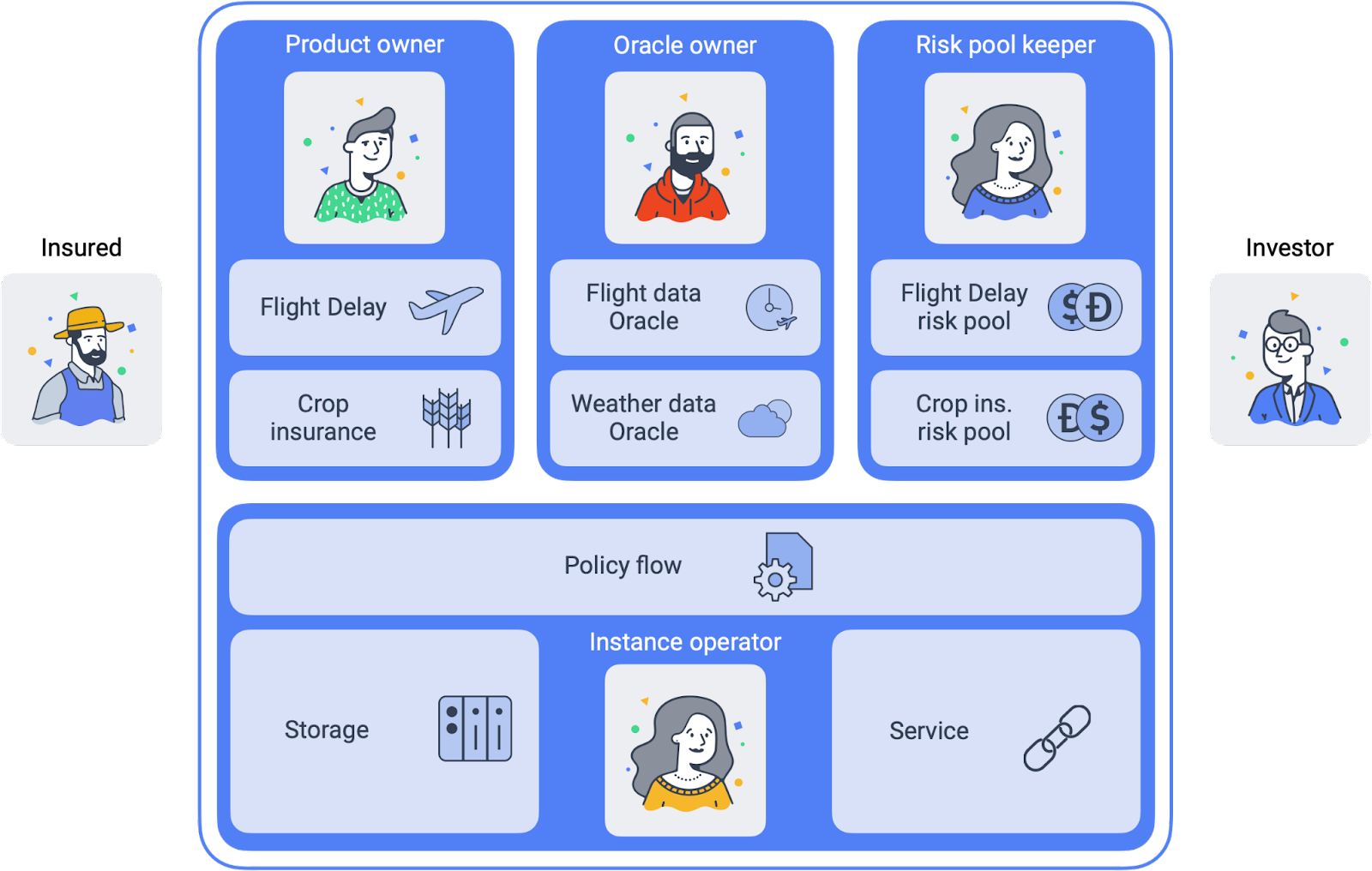

The picture below provides an overview of the stakeholder roles involved with a GIF instance.

Stakeholder roles

-

Insured/Customer

The Insured / customer is the policyholder who wants to pass his risk to the risk pools. He is a customer of the insurance company. -

Investor

Investors have an interest to participate in risk pools to balance/diversify their risk portfolios. Investors provide collateral for risk pools in exchange for interest payments. -

Oracle owner

The oracle owner provides oracles that interface between the blockchain smart contracts and external data sources. For example, in the case of flight delay insurance, the oracle informs the smart contract whether the flight landed in time, how much it was delayed or if it was canceled entirely. For weather index insurance, an oracle could provide historical and real-time weather data like rainfall, wind speed, etc. -

Product owner

The product owner designs and operates one or more products. This would be an insurance company or an MGA (managing general agent) in the traditional insurance industry. Due to the multi-client capability, a product owner can use all oracles located on the respective platform by the oracle owners. -

Risk pool keeper

A risk pool keeper manages one or more risk pools. A risk pool is a smart contract that assigns (“pools”) several risks, represented by policy objects, to risk capital.

Risk pools can collect collateral that investors invest in. Risk investors allocate and lock DIP token and /or stable coins in the risk pool and receive a reward for binding their assets. This process is called “staking.” Losses are paid from the risk pool. Therefore, the capital in the pool (more specifically, the stablecoin part of the pool) is at risk. Investors can top up their investments in the risk pool and withdraw their funds. However, before withdrawing their funds, the risks they bear must expire or be paid out.

DIP tokens link to access risk pools to investors who have also invested in the platform represented by this GIF instance. -

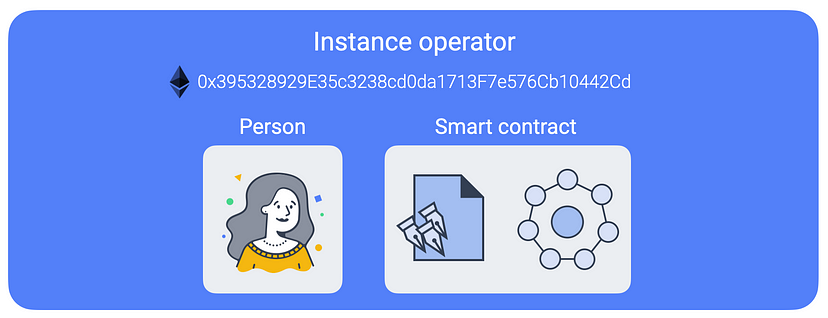

Instance operator

The GIF is a framework, i.e., a collection of open-source smart contracts. Any complete deployment of this framework is called a “GIF instance”. There will always be at least one complete instance of the GIF which is operated by the Etherisc project, but in principle, anybody can deploy a new GIF instance. The instance operator is the key role which operates a specific GIF instance.

The key responsibilities of the instance operator are the administration of products and oracles (as introduced above) and a few other basic actions. Any GIF instance is multi-client capable, which means that any number of product owners and oracle providers can be operated and administered on one GIF instance. Due to the different legal regulations for insurances worldwide, it can turn out that different GIF instances and, therefore, several instance operators are required.

The instance operator is represented by an Ethereum address. Therefore, the instance operator could be a natural person owning the private key of that address or a smart contract - either a multisig (a digital signature scheme that allows a group of people to sign a single document) or a DAO (d\Decentralized Autonomous Organisation) structure. This enables a completely decentralized operation of any GIF instance.

One address can, of course, manage several independent GIF instances.

The dedicated goal of the Etherisc Project is that control over all GIF instances will be handed over to DAOs controlled by the platform’s stakeholders (customers, product owners, oracle owners and risk pool keepers).

Generic lifecycle functions in GIF

Core objects of the GIF

Any instance of the GIF maintains collections of three basic objects:

-

Products

-

Oracles

-

Risk pools

Each object has its own lifecycle, which we discuss in the next paragraphs.

These three basic objects are connected by the framework to execute the lifecycle of insurance policies, which are also maintained as objects in the framework.

Product lifecycle

The product life cycle defines the stages a new product will undergo.

A product is a specific smart contract that implements the functionality of this product. The product can implement its specific requirements, or it can use the generic functionality of the GIF. After the product is technically developed and deployed to the blockchain, it must be registered in the GIF instance. This action is typically integrated in the deployment process.

The GIF instance offers the following functions to the product owner for this:

-

registerProduct

After registering a product, it needs to be approved by the instance operator. The instance operator will check the details, such as no malicious code in the product contract, and may impose other requirements for approval of the product. A possible and likely requirement is that the product owner stakes a certain amount of DIP token in a particular contract and then must be actively selling products and earning money on the platform.

Approval is made by the instance operator using the function -

approveProduct

After approval of the product, the product is active and can start selling policies.

Should there be a change in terms imply a re-deployment of the product, the old product needs to be deactivated. For this, the GIF instance offers two functions: -

pauseProduct

A product which shouldn’t be sold anymore, or is defective, can be paused. -

unpauseProduct

This reverses the effect ofpauseProduct.

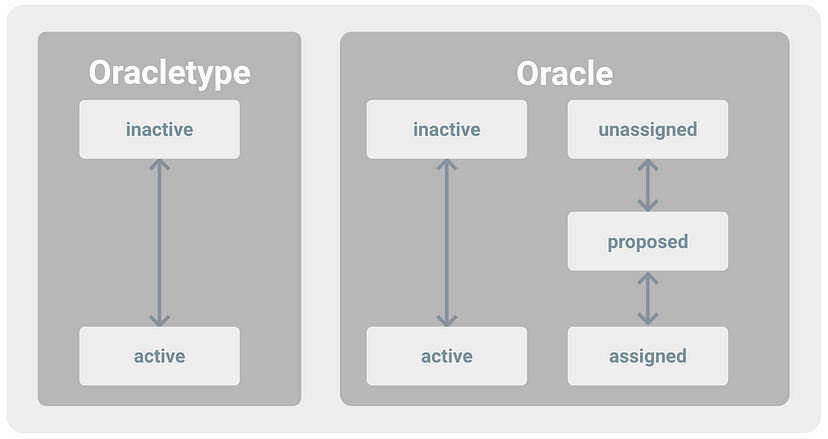

Oracle lifecycle

Oracles form a vital part of the GIF, as they link the blockchain-based smart contracts and the index / parameter information necessary to operate real-world insurance products.

Products can utilize product-specific oracles, but they can also make use of generic oracles, which can, in turn, be implemented by many different parties.

For example, the FlightDelay ratings oracle has one input parameter, the carrier/flight number combination, and one output parameter, an array of integers which represent the historical number of delays for different amounts of delays.

There can be an arbitrary number of oracles implementing this service.

An oracle owner can propose oracles that they would like to offer (in case of the oracle owner) or use (in case of the product owner). The instance operator checks the suggested oracles and activates them after successfully checking. The instance operator can deactivate or remove the oracle as well, if necessary.

The following functions are available for oracles:

-

proposeOracle(oracle owner) -

activateOracle(instance operator) -

deactivateOracle(instance operator) -

removeOracle(instance operator)

Risk pool lifecycle

The risk pool lifecycle will be described here as soon as the implementation is published.

Policy lifecycle

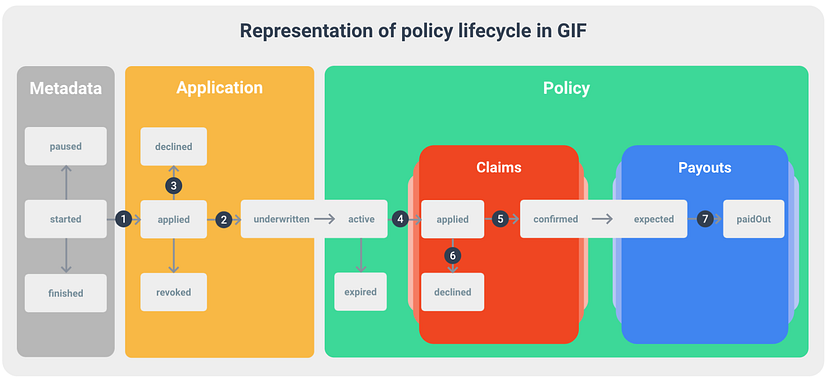

Independent of the specific product, each policy that is processed on the GIF instance has a lifecycle. Typically, a policy undergoes several state changes during the lifecycle. While any product designer could implement his own lifecycle (in our terminology, the life cycle is called “PolicyFlow”), the GIF offers a default lifecycle which should be sufficient for most use cases. This generic life cycle is called “PolicyFlowDefault”.

The “PolicyFlowDefault” lifecycle offers the following functions:

-

_newApplication(to generate and store a new application from a customer) -

_underwrite(to sign an application and create a new policy) -

_decline(to reject an application) -

_newClaim(to generate and store a new claim in case of loss) -

_confirmClaim(to confirm a claim and create a payout) -

_declineClaim(to reject a claim) -

_payout(to confirm and initiate a payout)

The names of these functions start with an underscore to indicate that they are internal functions that you can override in your product. For example, you are free to have the newApplication function in your contract and also use _newApplication in it.

Payments

The GIF instance is agnostic to the way payments are made. Therefore, we don’t offer specific functionality for this.

Pure crypto payments can be made directly to the product contract, while fiat payments need a fiat gateway and potentially an external banking or credit card infrastructure.

Information on how to implement fiat gateways can be requested from the core team.